August 2020

Enterprise Technology Partner Ecosystems: Microsoft

Microsoft’s Narrow Focus on an Enterprise Technology Vendor

Microsoft has built a strong portfolio of enterprise-focused products and services that have resulted in a far-reaching partner network. Today, Microsoft is one of the leading providers of enterprise technology in the world. Since the introduction of Azure in 2008, it has gained market share in the cloud space at enormous speed.

This report explores the significance and dominance of Microsoft’s offerings in today’s business world and the impact on Microsoft’s partner ecosystem, as well as highlights what’s next for Microsoft and M&A activity within the space.

Don’t miss any of our new research, subscribe here to receive monthly updates.

Market Overview

COVID-19 is pushing many businesses to rethink their operations and technology standards – according to a survey by IFS, most businesses are doubling down on investments in enterprise

technology as a result of the pandemic. 50% of respondents to the survey reported that they plan to increase spending, and another 20% responded that they would keep spending around

current levels (1). With workforces transitioning to a work from home model, businesses are being forced to reevaluate the adoption of technologies to keep operations at pre-pandemic levels. Many organizations realize that investments into digital infrastructure are of higher priority than ever, with some executives indicating that companies could face serious consequences if investments into digital capabilities are not made.

Some of the largest providers of enterprise technology include Microsoft, AWS, Google, Adobe, and Salesforce. While most of these companies are providing tailored solutions, like customer relationship management (CRM) or enterprise resource planning (ERP) systems, many have backgrounds outside of enterprise technology. AWS, as one business unit within Amazon, was founded as an e-commerce platform that developed an internal data management system later marketed as AWS. Similarly, Google’s history is that of a consumer-focused internet search engine. Microsoft, on the other hand, has remained true to its roots of developing hardware and software for personal and enterprise use.

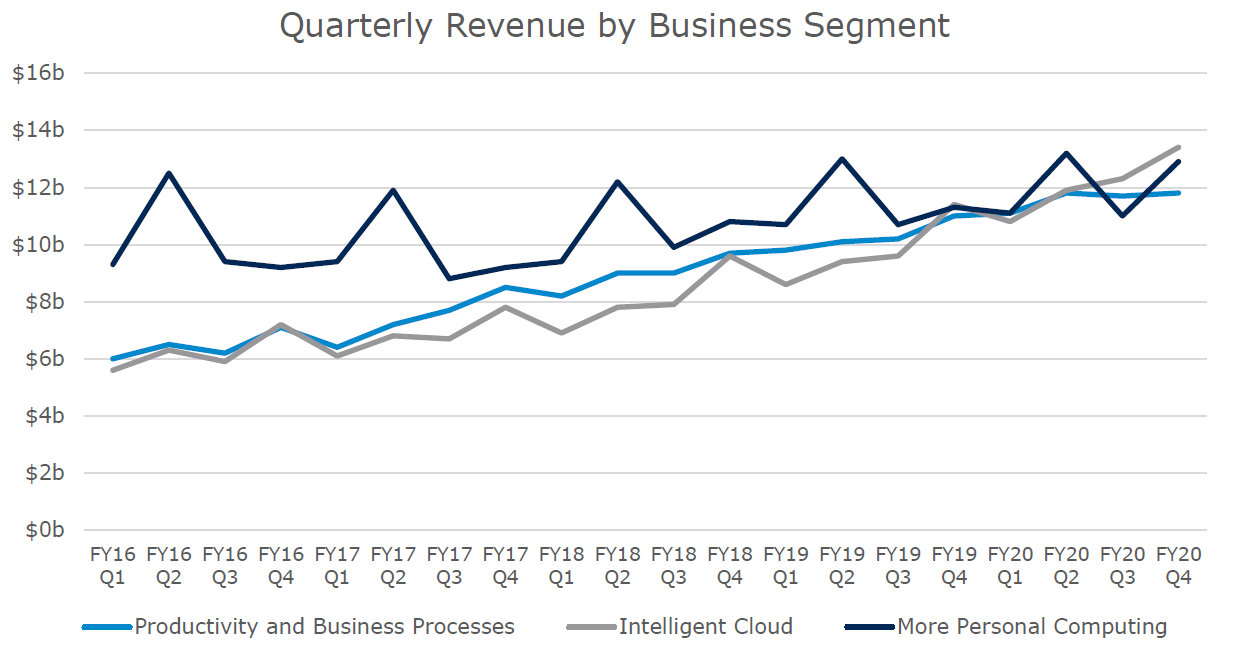

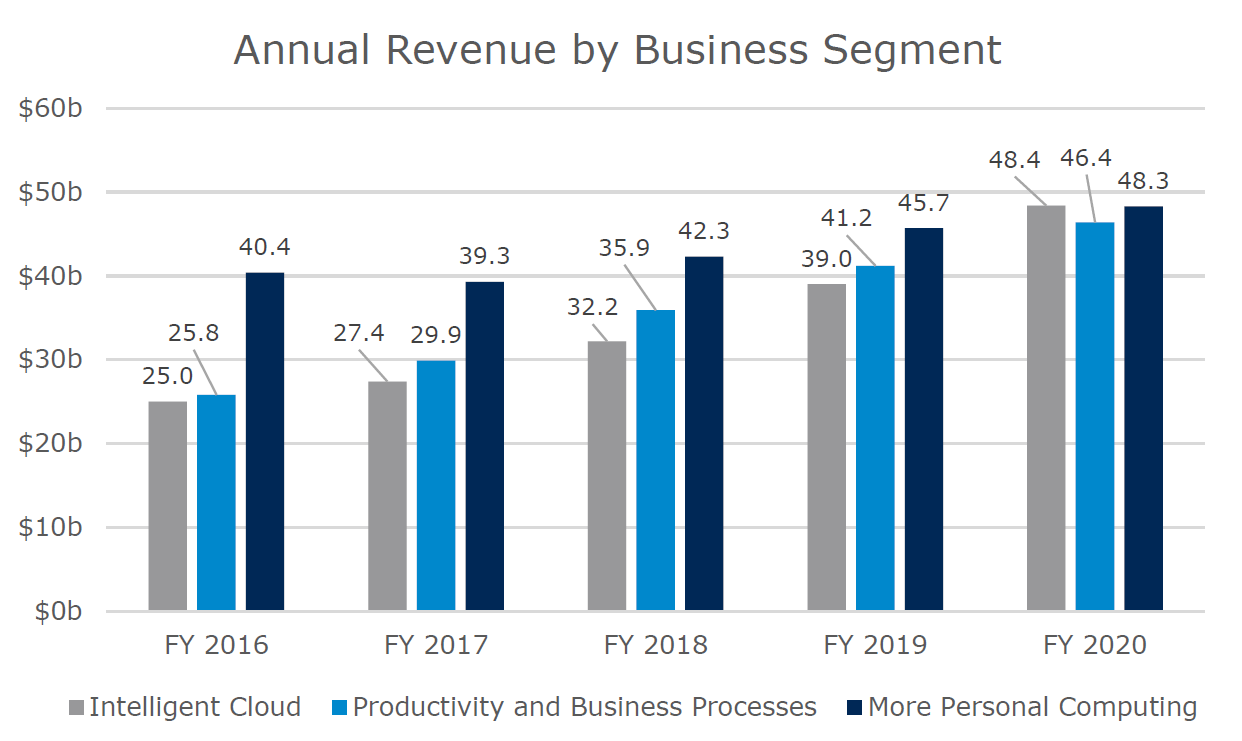

The dedication to enterprise products is a critical differentiator for Microsoft, driving strong financial performance. In fact, over the last 3 years, Microsoft grew revenue 14%+ YoY, while

exhibiting double-digit EBITDA growth, bringing EBITDA margins to a solid 46%, a direct reflection of the growing user base the company is reporting on. Office 365 recorded more than 180 million users in the commercial space, while Microsoft EMS and Outlook apps both exceeded 100 million users in FY 2019. By division, the company saw a 15% and 21% growth in Productivity and Business Processes and its Intelligent Cloud offerings respectively (2). Office, Commercial, and Dynamics revenues increased by 13% and 15% respectively, while Microsoft’s cloud offering showed 21% revenue growth in FY 2019.

The Microsoft Ecosystem is uniquely positioned to deliver a holistic set of solutions, enabling the next generation of business. Its digital feedback loop allows an end-to-end connection of data and

analytics for any kind of business application, from customer interaction to back-end operations. Microsoft’s full-cycle approach to products and services allows it to be specifically tailored to

enterprise clients that are incentivized to utilize as many of Microsoft’s offerings as possible, as they are tightly integrated. “Its offerings cover both devices and clouds, including non-Microsoft

operating systems and devices. With its ‘Intelligent cloud, intelligent edge’ strategy, the Microsoft ecosystem combines the virtually limitless computing power of the cloud with intelligent devices at the edge. This platform has established a powerful foundation for building immersive and transformational business solutions. Blending the physical and digital world as a mixed reality,

the Microsoft ecosystem realizes the vision of the future and remains well positioned during this ever-changing digital age (3).”

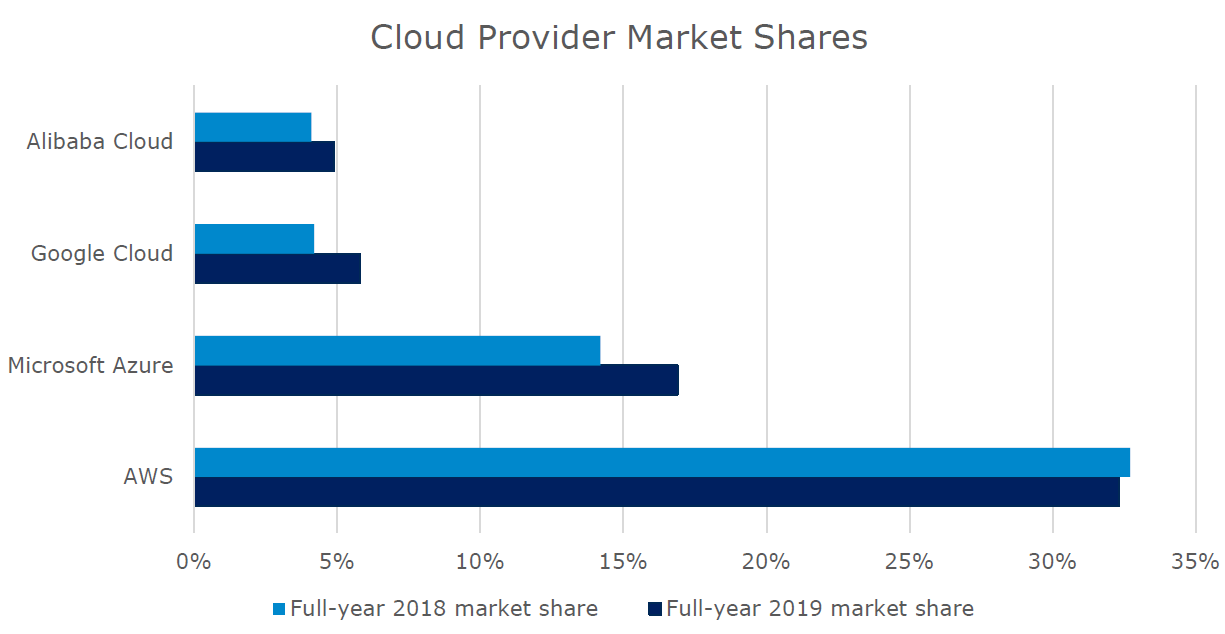

Microsoft was an early provider of cloud computing and is now a clear leader among Infrastructure as a Service (IaaS) providers with Azure, a cloud computing platform for building, deploying, and managing services and applications. While AWS remains the leader in the cloud marketplace, serving about a third of the overall market, it is losing contracts due to competition among large retailers, grocers (Whole Foods acquisition), and more recently healthcare providers, demonstrating that the cloud war is well underway. Microsoft remains narrowly focused on enterprise technology solutions and saw accelerated market share growth between 2018 (14%) and 2019 (17%) (4). A major win for Microsoft came with the nomination for the Joint Enterprise Defense Infrastructure (JEDI) contract worth up to $10 billion over the next 10 years (5). The contract helped Microsoft to solidify its position within the cloud market as it beat its comp set in AWS, IBM, Oracle, and others.

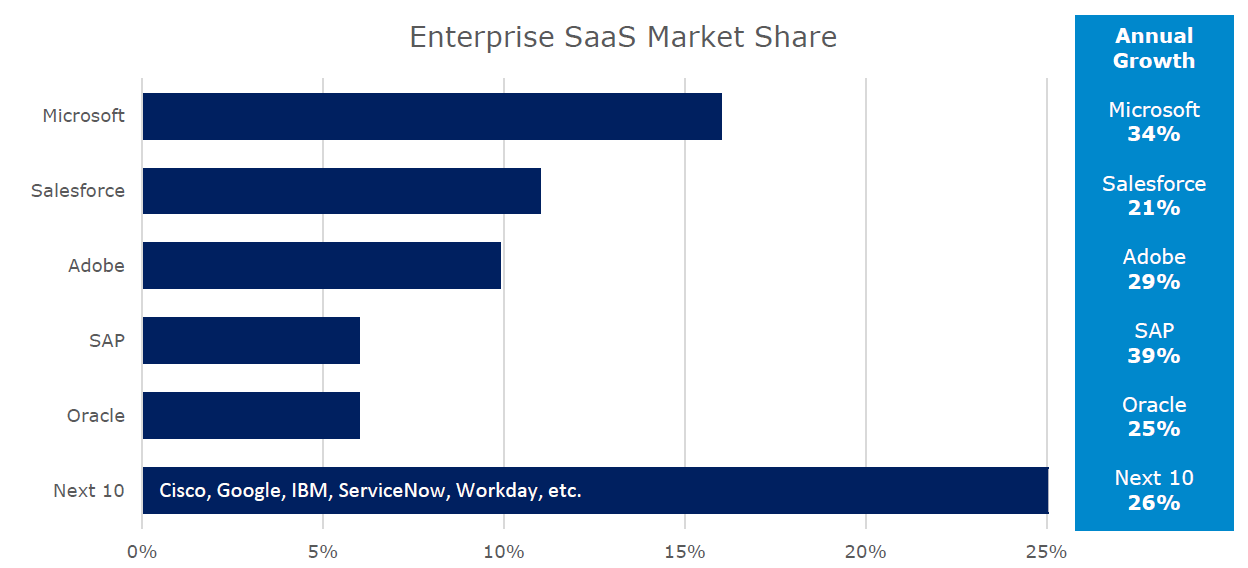

Microsoft is a rising player in the cloud marketplace and surely a front runner in all things enterprise technology. As of 2019, Microsoft had the largest market share in the Enterprise Software as a

Service (SaaS) space with over 16% and an annual growth rate of 34% (6). Here, the company is benefiting from its deep ties to enterprise clients and the interconnectivity and flexibility of the Microsoft Dynamics suite.

Dynamics 365, another major platform offered by Microsoft, consists of a number of business intelligence applications, including CRM and ERP solutions, that allow enterprise clients to take a

proactive stance on business operations by applying artificial intelligence. Further, the applications allow a variety of departments, such as sales and customer service, finance, marketing, and

operations, to interconnect and share insights across applications. It comes as no surprise that Dynamics also integrates into Azure, providing a common data storage for all applications.

Microsoft Power Apps, another area of accelerated growth, consists of a platform that allows for rapid software and application development. The platform allows for the creation of customized

solutions that are directly connected to data stored in a variety of locations, including the underlying data platform and various on-premise or cloud sources. The applications are built in a low code environment that enables end users to actively participate in the creation of the customized end solutions.

The race to the cloud is well underway and a high priority for Microsoft going forward, but expect Microsoft to round out its solution set in a parallel race to be an all-inclusive solutions provider; an equally critical race with vendors such as Google, Adobe, and Salesforce who are shifting away from their core businesses and rapidly adding solutions across the IT stack. Already a market leader in cloud, collaboration apps, ERP and CRM, data, analytics, and ML / AI, Microsoft could shift into areas such as marketing automation, commerce, and content in a head-to-head battle with Adobe and Salesforce – the company already introduced tools such as Dynamics 365 Commerce. There is speculation that Microsoft is in the process of developing a single-tenant e-commerce platform, similar to Shopify.

How Does This Impact The Partner Ecosystem?

Microsoft is one of the world’s largest technology providers and therefore one of the top vendor ecosystems for enterprise technology. Microsoft is at the forefront of the cloud war with Azure and a clear #2 only behind AWS. Microsoft’s early start, in collaboration with Microsoft Office and database in Microsoft SQL Server, gave it an initial inroad to the enterprise technology market and a head start on building out a robust partner ecosystem with .NET developers. Not only is Azure a leader in cloud computing, but Microsoft Teams, launched in 2017, Office 365, launched in 2017, and Dynamics 365, launched in 2016, are all leading cloud products and applications in their respective categories enabling workforces to work nimbly and remotely. Teams alone passed 75 million daily active users in the spring of 2020. As Microsoft continues to rise as a leader in the industry and as organizations of all sizes undertake multi-million-dollar projects to shift towards cloud environments and applications, partners are experiencing enormous demand for their services driving investment and overall M&A activity. 7MA is tracking consistent deal activity in the Microsoft space over recent years, as shown on page 9, and anticipates this to increase even more quickly with the acceleration of cloud adoption due to COVID-19.

7 Mile Microsoft Transactions

- Belatrix acquired by Globant (Sellside Advisory)

- Microsoft Services Business of SADA Systems acquired by Core BTS (Sellside Advisory)

- Intellinet acquired by FPT (Sellside Advisory)

- AgileThought acquired by AN Global (Buyside Advisory)

- Sonoma Partners acquired by EY (Sellside Advisory)

- NetServe365 acquired by Magna5 (Sellside Advisory)

Coverage Team

- Leroy Davis, Partner

- Garth Martin, Vice President

- Robin Siegel, Analyst

For additional research on the IT Services space, view our recent Sectorwatch benchmarking reports here.