January 2023

Market Update: Cloud Services Q4 2022

The demand for cloud services implementations remains at the forefront of corporate focus as businesses continue to adapt to the new paradigms of remote work and digitalization. In an ever-increasingly competitive market where consumers demand the ease and flexibility of online infrastructure, CEOs and management teams have continued to put a focus on the cloud in order to survive and continue growing.

According to a recent Acceleration Economy study of the industry’s leading cloud providers, Oracle generated the highest quarterly growth rate of 43%, while Salesforce had the lowest at 14%. This study also forecasted Microsoft’s revenue to grow approximately 25% and increase to almost $100 billion in 2022. Despite this strong growth, some analysts believe all providers could grow even more as the most aggressive estimates say that cloud penetration has barely reached 25-30%. This means that there is still 70% of a trillion-dollar market that remains untapped.

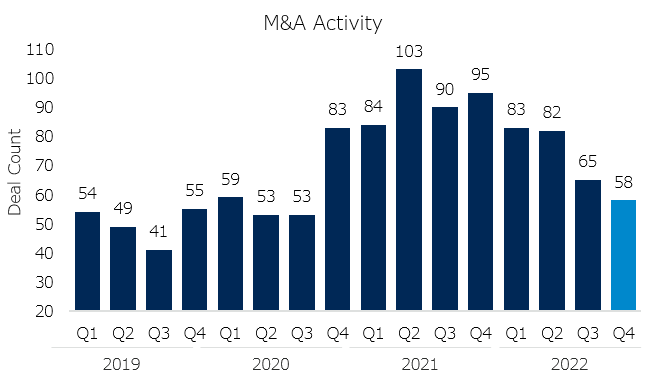

7 Mile’s focus in this market update is on M&A activity within the Cloud and Enterprise Applications space. In Q4 2022, deal activity continued to lag the record levels seen in 2021 yet remains in-line with longer-term historical averages.

7MA has completed numerous M&A transactions for companies in the cloud services space and has developed unparalleled deal expertise and knowledge of the industry trends, valuation trends, and most active strategic and financial buyers. Please contact John Cooper, Tim Frye, Garth Martin, and Ilia Ulianchuk if you would like to learn more.