Things are Heating Up in the Analytics Space: Google and Salesforce.com Ecosystems

By Garth Martin | June 14, 2019

Overview

According to Bank of America Merrill Lynch’s Cloud Wars XI, there are five critical palettes in the digital transformation space, of which the largest two Total Available Markets (TAM) estimated for 2023 are Customer Engagement ($75.5b) and Business Analytics ($26.9b) [1]. Based on recent events, it appears that Google and Salesforce are buying into the expected growth in the analytics market, quite literally. On June 6th Google announced its plans to increase its enterprise software suite with a $2.6b all cash acquisition of Looker, pending approval by regulators. This week, following the publication of the Looker deal, Salesforce.com announced their acquisition of a Looker competitor and arguably the industry leading Business Intelligence (BI) tool, Tableau for $16.3b [2]. So what does this mean for these two tech juggernauts and the BI space, and more importantly, what does it mean for the analytics space?

Google Takes Down Looker

Deal Analysis

The acquisition was announced on June 6, 2019 at an enterprise valuation of $2.6b. Looker, a privately held BI software, hit the ground running and since its inception in 2012 has raised $280.5m. In 2017, Looker raised $81.5m in a series D led by none other than CapitalG, Google’s venture capital arm [2]. This is an approach many enterprises are taking in order to keep tabs on, and gain early access to, early stage startups.

Looker was a high-growth story most recently reporting a run-rate of over $100m in revenue, revenue growth of 70% year-over year in 2018, and 500 added customers in 2018 (i.e. Cisco, ESPN, Marks and Spencer Plc, Trivage, Five Guys, Adyen, Live Nation Entertainment, and more) [3]. Assuming a very approximated run-rate of ~$150m around the time the deal was closed (Looker reported a run-rate of over $100m in late 2018), we estimate a ~15x+ run-rate revenue multiple on the Looker transaction – a premium valuation demonstrating the markets expectations for cloud-based data visualization tools. Much like its peers and other high-growth software companies, I anticipate Looker is not yet profitable due to high SG&A spending for R&D and Sales spending focused on fueling growth.

More on Looker

In 7MA’s recent whitepaper on the analytics space, we highlighted Looker as an up-and-coming player within the BI space. Looker has a less robust technology ecosystem in comparison to a Tableau, but is still a leading software platform recognized on Gartner’s Magic Quadrant for Analytics and Business Intelligence Platforms [6]. Looker now has approximately 1600 clients overall (i.e. IBM, Spotify, Etsy, Lyft, Kickstarter, and more), nearly 600 employees, and added more than 200 employees throughout its seven offices in 2018. Earlier this year, Looker expanded into Asia-Pacific by opening operations in Tokyo, Japan [3].

Other recognitions include:

“In 2018, Looker was named an Enterprise Business Intelligence Leader in the Gartner FrontRunnersreport, received a perfect Recommend score from customers in the Wisdom of Crowds Business Intelligence report from Dresner Advisory Services, named a Leader for Business Value in BARC’s The BI Survey 18, and once again was named a Leading BI Vendor in the G2 Crowd Business Intelligence Platforms report.” [3]

What does this mean for Google?

So the real question: What does this mean for Google and why did they get go deeper into the analytics space? To answer this question we need to go no further than to take a look at

1) Google’s recent progress with their Google Cloud Platform, where Looker will ultimately sit and

2) Microsoft’s product suite.

1) Google’s Track Record

Over the past several years, the Google enterprise suite has rapidly expanded. The Google Cloud Platform has grown into a real contender in the public cloud space taking market share from AWS and Azure. Recently they’ve gained momentum as many firms look for AWS alternatives considering Amazon directly competes with nearly all retail industries, and now the food industry thanks to the Whole Foods acquisition.

Originally, the G-suite (google docs, google sheets, gmail, google drive, etc.) started as relatively “light” applications not widely used as enterprise technology and more commonly for personal use. Today, as companies need flexible and adaptable software to transform with their own businesses in a world moving faster than ever before, Google products have found a place in the enterprise and are rapidly gaining momentum. 7MA is seeing this adoption first hand as Google partners drive higher valuations in the IT Services sector. Not only that, but Google also made previous acquisitions in the cloud space building out their cloud based tools. In February, 2019, Google acquired Alooma, a smaller data-migration firm, for an undisclosed amount. Alooma had raised $14.7m to date in venture capital leading up to the acquisition [2]. Cloud market potential and competition with Microsoft drives Google’s Cloud Platform development.

2) Competing with Microsoft

Microsoft has a long track record in enterprise technology with the Microsoft Office suite and within the last several years developed its Power Platform (Power BI, PowerApps, Microsoft Flow) in conjunction with its Azure and Office offerings meeting customer demands in the area of data ingestion and visualization – these tools have a lot more horsepower than excel spreadsheets. Google on the other hand, was lacking in this area outside of BigQuery database. Having Looker within their cloud product offerings provides a direct comparison to Power BI. With this aggressive step into BI software I expect another acquisition in the Big Data, Data Warehousing or Data Prep space – tools used to aggregate data properly prior to analysis or visualization. There are already reports of Google potentially taking down Cloudera, a publicly traded data warehousing firm that merged with HortonWorks in 2018 [7]. Several weeks ago, Google publicly announced a strategic partnership with Snowflake, one of the largest privately held (raised ~$1b) cloud-based data warehousing tools and another potential target [2]. For now, Looker will still be compatible with AWS and Azure [7].

Source [4]

Salesforce Takes Down Tableau

Deal Analysis

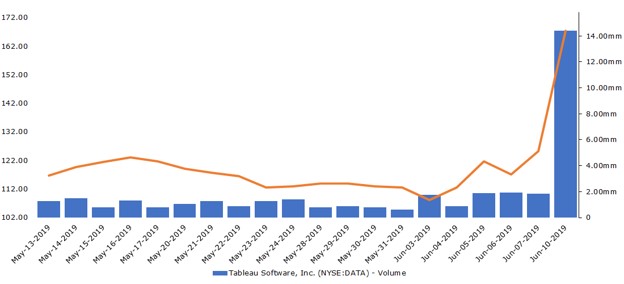

Similar to Google’s acquisition, the Salesforce acquisition of Tableau reiterates the importance of capturing data in the age of information. The public data driven disruptor was founded in 2003, went public in 2013 for $250m, and now acquired on June 10, 2019, for an implied enterprise value of $16.3b in an all stock deal with an implied LTM revenue multiple of 13.7x. Fueling the high valuation, Tableau was growing rapidly (31.7% revenue growth YoY in 2018) and had industry leading gross margins (87.1% in 2018). Tableau’s share price jumped by 33.7% the day the acquisition was announced [1]. Multiple reports state Salesforce intentions to operate Tableau as a standalone subsidiary.

Tableau Stock Price

Source: [2]

More on Tableau

Tableau, similar to Salesforce, is a software company committed to client success creating one of the most appealing aspects of using Tableau: The Tableau Community Group. A group for all Tableau users to collaborate, post and problem solve their specific Tableau problems. Directly from the CEO’s email after the acquisition was announced,

“We believe data is the primary fuel for digital transformation, and that together with Salesforce we are best suited to serve your needs. Being part of Salesforce means we can innovate faster. Matching Salesforce’s leading capabilities across many CRM areas including sales, marketing, service, application integration, and AI for analytics with Tableau’s leading rich analytics capabilities and visual interfaces is a great win for customers.”

Tableau currently has ~86k customers including Charles Schwab, Verizon, Schneider Electric, Southwest and Netflix.

What does this mean for Salesforce?

With this acquisition Salesforce is making leaps to become an enterprise software powerhouse mirroring that of Microsoft, SAP, and Oracle. Salesforce has changed the industry when it comes to CRM vendors and is currently unmatched even in Gartner’s Magic Quadrant for CRM technology [8]. Salesforce, a fairly acquisitive organization with four deals already announced in 2019, until now hasn’t expressed a ton of interest outside of marketing software. The acquisition of Tableau dwarfs post Salesforce deals coming in at $16b+ nearly tripling the size of the next largest acquisition (Mulesoft, Inc. in 2016) [2]. This ambitious purchase demonstrates the market opportunity available in the enterprise technology space as companies like Google, Microsoft and Salesforce are stealing more and more market share from legacy software providers.

Tableau and Salesforce were already go-to-market partners with integrations of Tableau’s reporting capabilities within the Salesforce platform allowing users to more easily track opportunities, manage relationships, and track sales staff successes. According to several press releases and directly from the Tableau CEO himself, the company will continue to operate as a stand alone entity, but provides Salesforce with now a second industry leading enterprise software platform.

For technology implementers, we anticipate an opportunity for the convergence of digital marketing firms and analytics management consultancies. Salesforce integrators typically cross-sell other marketing services (i.e. SEO, website building, content creation, email campaigns) to clients looking to revamp their overall customer engagement. We already saw technology integrators and consultancies offer BI solutions as their clients demanded more real-time insight into the success of marketing strategy, client conversion rates, cost of customer acquisition and more. We anticipate the BI capabilities and offerings of these integrators to accelerate much faster driving more M&A activity as global SI’s (system integrator) will race to lead this customer engagement focused analytics space.

Source: [5]

Implications for Google & Salesforce Ecosystems

These two deals have pretty big implications for both of the technology ecosystems, an area that 7MA has a lot of advisory experience. For starters, these are GREAT moves for both Google and Salesforce. The data analytics space has high expectations and enterprises are buying in BIG TIME. Management teams are willing to spend an arm-and-a-leg to understand optimal pricing for customers, product cost analysis, geospatial analysis, customer buying trends and more all as fast as possible, accessible from any location and in a clean and digestible format. If we take that one step further, enterprises want this to happen on the cloud for flexibility across the enterprise.

For Google partners and Salesforce partners, the ability to provide an all inclusive tool set for clients and the seamless integration offered is indispensable. Google technology partners can now lead with extensive analytic implementations using Looker then transition that engagement into a sticky recurring resale of a Google Cloud subscription. The Salesforce acquisition demonstrates the convergence of the CMO, CTO, CIO and CFO and allows technology partners to provide a more comprehensive software solution to senior management in a unified fashion. These two enterprises are betting on their enterprise technology and the cloud market big time.

For the broader BI and Big Data space, I think these acquisitions have some huge implications for Microstrategy and Qlik which have underperformed by comparison to Tableau and Looker. I anticipate other large enterprise software providers to seek out these two platforms in an opportunity to compete in this ever evolving landscape where analytics platforms are a major pillar of the digital transformation. Perhaps Amazon, who until now has remained quiet in this space, will pursue a BI vendor or data warehousing tool (Qlik, Alteryx, Snowflake) to enter the enterprise software space, or Oracle might pursue Microstrategy for their similar Fortune 100 client profile. 7MA is excited to see this play out as I am sure you are as well.

7MA Recent Deals

Sundog has been acquired by Perficient [Details]

Uniguest has acquired Touchtown [Details]

Footnotes

[1] – Cloud Wars XI: The Art of Software. Nine DX Platforms create art from Five Palettes

[2] – CapIQ

[3] – Looker Closes Series E Financing

[4] – Google is Set to Buy Data Analytics Company Looker for $2.6b

[5] – Salesforce is acquiring Tableau for $15.7b

[6] – Gartner Magic Quadrant

[7] – Google acquiress Looker for $2.6b to add its business intelligence software to Google Cloud

[8] – Gartner Magic Quadrant CRM

About 7 Mile Advisors

7 Mile Advisors provides Investment Banking & Advisory Services to the Business Services & Technology Industries globally. 7 Mile Advisors advises on M&A and private capital transactions, and provides market assessments and benchmarking. As a close-knit team with a long history together and a laser focus on our target markets, 7 Mile Advisors helps its clients sell companies, raise capital, grow through acquisitions, and evaluate new markets. For more information, including research on the M&A markets, visit www.7mileadvisors.com.

All securities transactions are executed by 7M Securities, LLC, member SIPC/FINRA.