Facility Management Market Overview

The Problem: Facility managers and physical asset managers for large enterprises are faced with a daunting problem: How can you effectively track, properly maintain, and optimally make decisions on thousands of assets across large complex facilities in a rapidly changing business environment? For example, imagine you are now awarded the responsibility of overseeing all physical assets in JFK Airport (i.e., chairs, booths, fire extinguishers, etc.). Where would you begin? Consider all of the necessary maintenance steps required to appropriately keep those thousands of assets in service. Now consider you are a facility planner for all McDonald’s locations, including corporate facilities, in the U.S. (~14,000+ locations) and are responsible for optimizing space, managing capital expenditures on real estate, maintaining facility maintenance schedules, and accounting for leases appropriately, while considering the environmental impacts. The problems facing large enterprises managing various real estate portfolios with countless fixed assets are extremely complex.

The Solution: A software to meet the needs facing facility managers. Two primary segments of software products solving this problem:

- Enterprise Asset Management (EAM)

- Integrated Workplace Management System (IWMS)

EAM Overview

What are Enterprise Asset Management systems and what are they used for? Essentially, EAM tools help large enterprises effectively manage vast portfolios of physical assets. Within the EAM space there are several additional solutions including CMMS (Computerized Maintenance Management Systems) and CAFM (Computer-aided Facility Management) intending to solve this problem, but EAM tools are typically the most robust. Industries using EAM tools include: Oil & Gas, Utilities, Transportation, Life Sciences, and Aviation. According to ISO 55000 (organization setting out to create a common framework for asset management) and IBM’s interpretation of this release: “the primary objective of an effective asset management program is to ensure that assets maximize value to all stakeholders in the value chain, throughout the asset’s lifecycle” [1.2].

Primary Capabilities [1.1]:

- Extend asset life

- Manage asset location, repairs, resources, skills and more

- Maintain compliance with regulatory requirements

- Integration with ERP systems

In recent years, advancements in IoT and Artificial Intelligence help drive more effective solutions in the EAM space. Now enterprises have access to live reads on a larger portfolio of assets and enable proactive maintenance [1.2]. In Gartner’s Magic Quadrant for Enterprise Asset Management Software report, EAM is considered a mature market similar to the ERP market experiencing low single-digit growth with low churn rates for several years. This landscape is filled with legacy providers offering outdated products. Gartner expects these vendors to focus on partnerships with or developments of internal APM (asset performance management) and AIP (asset investment planning) tools; a growing area in asset management [1.3].

Leading EAM Vendors [1.3]:

IWMS Overview

What are Integrated Workplace Management Systems? According to Planon Software, IWMSs “are software solutions that enable executives and managers to reduce facility management costs and increase business productivity, compliance, and transparency” [1].

Primary Capabilities [2]:

- Real estate and facilities management

- Capital project management

- Space management

- Facility maintenance

- Environmental and energy management

When considering the IWMS, each situation is extremely unique, requiring an overhaul of customization and software implementation to provide the appropriate solution for each use case. Software products aren’t as easy as a straight-out-of-the-box solution. This need for customization and highly complex system implementation creates a market for IWMS consultants. The IWMS market is expected to experience continued growth through 2021 thanks to a variety of drivers. According to analysts and other industry experts:

“Global Forecast to 2021, is expected to grow from USD 1.52 Billion in 2016 to USD 3.35 Billion by 2021, at an estimated Compound Annual Growth Rate (CAGR) of 17.1% during the forecast period. The major drivers of this market include changing workforce dynamics, strict regulatory compliance, and increase in Corporate Social Responsibility (CSR) activities. Evolution of Internet of Things (IoT) and huge growth in application of cloud platforms across the globe provides vast opportunities for the IWMS vendors, service providers, and consulting companies” [3].

Leading IWMS Vendors:

- IBM TRIRIGA

- Fortive – Acquired Accruent & Lucernex

- Trimble Manhattan

- Planon

- Archibus

- SAP

EAM & IWMS Services Market

Looking into the future of this market we, along with Gartner and IBM, anticipate areas such as artificial intelligence, analytics, improved geospatial technology, and IoT will continue to drive growth and disruption in the EAM and IWMS market as enterprises need to make decisions based on exponentially larger data sets than seen in the past and at a faster pace. Also, as these enterprises grow, existing or new solutions have to meet those needs. Not only will this overall growth drive developments in software products, but it also requires implementation consultants to specialize in a wider range of tools and service offerings to offer the best solution for each problem. Overall global development is expected to grow according to a Deloitte commercial real estate report: 97% of global respondents anticipate increasing their capital commitments to CRE in the next 18 months (as of mid-2018) [1.4]. Both of these factors drive a strong EAM and IWMS market forward.

M&A Market

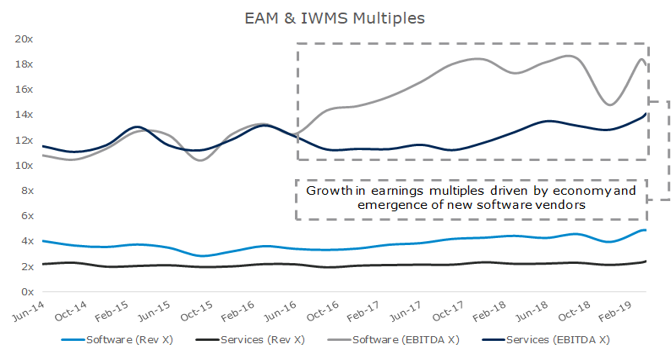

7MA tracked two buckets of public companies in the EAM and IWMS space: Service Providers (Tata Consulting, Perficient, CGI, Accenture, Wipro, Cognizant, NTT DATA, IBM, Infosys) and Software Providers (Pitney Bowes, AVEVA, Trimble, Hexagon, Fortive, SAP, IBM, Oracle). In the below graphic, 7MA trended revenue and EBITDA multiples for these enterprises over time.

Source Data: [6]

Software Provider Analysis: Several software vendors in this space provide legacy software solutions, explaining revenue trading multiples (~4x) slightly below other software vendors in other industries. As of the last several years, several smaller vendors emerged, driving an 11% CAGR in EBITDA multiples (4% CAGR in revenue multiples) in the period above. In Jul-18 Fortive announced its acquisition of Accruent, an example of a player that gained traction over competitors like IBM, Oracle and SAP. According to multiple public sources, Accruent sold for $2b and recorded ~$270m in 2018 revenue, implying a valuation of ~7.4x revenue well above the median seen previously on the public markets. We expect other vendors to disrupt this space in the coming years if large vendors don’t keep up with AI, IoT and analytic developments that smaller, more agile vendors are incorporating.

Service Provider Analysis: From a services perspective, valuations are relatively consistent with EBITDA multiples, growing by a CAGR of 4% (2% CAGR in revenue multiples) across the period above. Some of the most notable implementation providers in this space come from large IT Consultancies, but other consultancies in this space include management consulting firms, real estate services firms, accounting firms and boutiques. ValuD Consulting is a notable acquisition in this space that took place in Oct-18. ValuD Consulting largely consists of IBM TRIRIGA and Maximo consultants and was acquired by JLL under the thesis that “this enhanced expertise will provide clients with market-leading technology systems that enable faster, more informed real estate decisions and improved business performance” [7]. BGIS, a former Canadian subsidiary of Brookfield Business Partners, marks another notable transaction in this space selling for $1b in Mar-19 (announced) to CCMP Capital [8].

Recent Transactions

Microsoft Business Unit of SADA Systems acquire by Core BTS [details]

Southport Services Group acquired by Perficient [details]

Sources:

[1.1] – IBM Maximo

[1.2] – Understanding the impact and value of enterprise asset management

[1.3] – Gartner EAM Industry Report

[1.4] – Deloitte CRE Report

[1] – Planon IWMS Software Overview

[2] – IBM TRIRIGA

[3] – Markets and Markets IWMS Analysis

[6] – CapIQ

[7] – ValuD Consulting Press Release

[8] – BGIS Press Release

About 7 Mile Advisors

7 Mile Advisors provides Investment Banking & Advisory Services to the Business Services & Technology Industries globally. 7 Mile Advisors advises on M&A and private capital transactions, and provides market assessments and benchmarking. As a close-knit team with a long history together and a laser focus on our target markets, 7 Mile Advisors helps its clients sell companies, raise capital, grow through acquisitions, and evaluate new markets. For more information, including research on the M&A markets, visit www.7mileadvisors.com.

All securities transactions are executed by 7M Securities, LLC, member SIPC/FINRA.