May 2023

Market Update: IT Services & Software in Western Europe Q1 2023

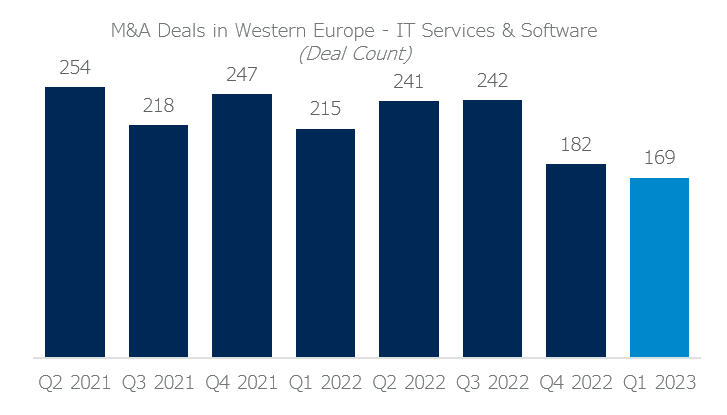

Following a notable decline in Q4 2022, global M&A activity struggled to regain momentum and decelerated again in Q1 2023. The first quarter of the year tracked global deal volumes of $559 billion, the third-lowest level of global M&A deal volume in the last 10 years.

The slowed activity was largely reflective of market sentiment and a product of widespread uncertainty, continued supply chain issues, surging inflation across developed and emerging countries alike, and the Russia-Ukraine conflict.

However, M&A activity exhibited a degree of dispersion across end markets as buyers continue to pursue thematic strategies and inorganic growth initiatives. Specifically, the tech, digital, media, and marketing sectors continued to demonstrate strength relative to the broader market with a modest decline in activity of 3% from Q1 2022. Verticals that provided strong support for the broader sector included digital services, AdTech/MarTech, and content & production.

7MA has completed numerous M&A transactions for companies with outsourced operations and delivery centers in Western Europe and has developed unparalleled deal expertise and knowledge of the industry trends, valuation trends, and most active strategic and financial buyers. Please contact Kristina Sergueeva or Ilia Ulianchuk if you would like to learn more about IT Services & Software across Western Europe.