January 2023

Market Update: Cybersecurity & Infrastructure Services Q4 2022

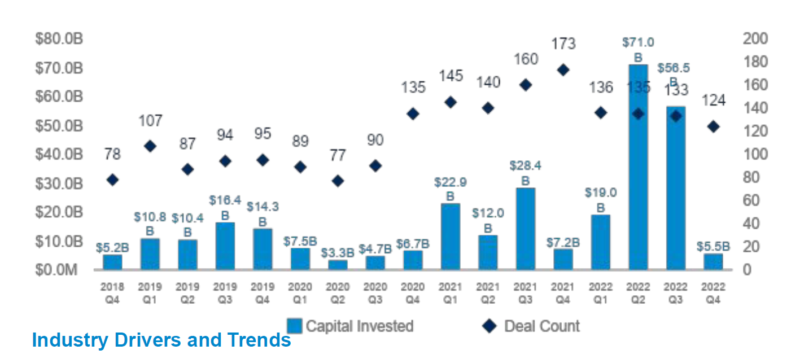

In Q4 2022, the Cybersecurity & Infrastructure Services industry saw nearly $5.5 billion of capital deployed for M&A and Buyout/LBO transactions in Europe and North America. The quarter also saw 124 deals across a bevy of sub-sectors, including primarily network management software, IT consulting and outsourcing, and business/productivity software. The majority of these transactions took place in the U.S.(+50.0%), U.K. (+10.0%), Canada (+5.0%), France (+5.0%), and Germany (+4.8%), among others. Geographically, this composition has stayed in line with historical trends.

Cloud Security – Driven by continued momentum following the COVID-19 pandemic and related shifts in employees’ workplace preferences, global supply chain disruptions, and cost optimization initiatives. In addition, the increased prevalence of data breaches and cybersecurity threats leads to regulatory pressures for enterprises to secure and protect data.

DevOps/DevSecOps – Driven by the growing risk of vulnerabilities introduced by development and operations. The rise in investment in advanced IT technologies such as AI and ML supports many automated processes used in DevSecOps. Despite the industry’s strong forecasted growth, the DevSecOps industry is impacted by constraints associated with the shortage of qualified and skilled personnel. Therefore, pursuing inorganic growth strategies with the benefit of talent acquisition presents an attractive investment opportunity.

MSSPs – The increased prevalence of hybrid working, employees working from home (WFH), and bring-your-own-device (BYOD) policies and the growing demand for robust and cost-effective security services to monitor and mitigate security threats has been driving the growth of MSSP during 2022. Forecasts of this service type show that it will continue growing at similar levels in the coming years.

API Security – The governmental support for API security solutions to mitigate financial risk, the increase in the frequency of malicious attacks on APIs, and the adoption of APIs to connect services and transfer data, have been driving the growth in API security during 2022. In line with this, major players are pursuing various strategies, such as partnerships, collaborations, and acquisitions, to increase their presence, customer base, and solution offering.

7MA has completed numerous M&A transactions for companies operating in the aforementioned sectors and has developed unparalleled deal expertise and knowledge of the industry trends, valuation trends, and most active strategic and financial buyers. Please contact Leroy Davis or Sydney Scadden if you would like to learn more about Cybersecurity & Infrastructure Services.