May 2023

Market Update: Cybersecurity & Infrastructure Services Q1 2023

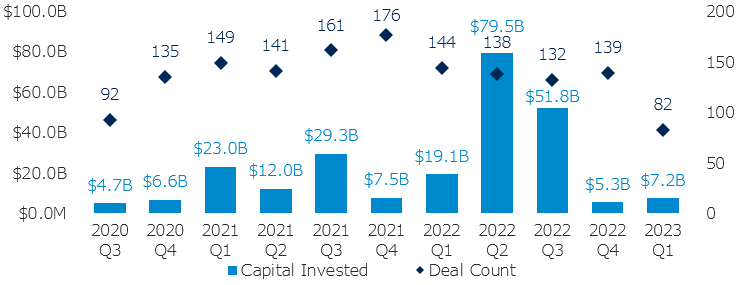

In Q1 2023, investors deployed $7.2 billion of capital across 82 M&A and Buyout/LBO transactions in the North American and European Cybersecurity & Infrastructure Services industry. The capital invested represented a 36% quarter-over-quarter increase and a 100% increase compared to Q1 2022. The United States accounted for a majority of the capital invested at 60.9%, while the U.K., Canada, and France accounted for 9.6%, 4.6%, and 4.5% respectively. Activity across these regions was relatively in line with historical trends.

Industry Drivers and Trends

Advancements in Artificial Intelligence (AI) technology have led to increasingly sophisticated social engineering attacks. Increasingly, attackers are leveraging chatbots to craft messages and deploy phishing campaigns that appear authentic and genuine. Advances in visual and linguistic AI models (deepfakes) are also utilized in phishing campaigns to deceive individuals into giving away private information by impersonating real people in real-time.

Although investors are exhibiting a degree of caution as they assess the impact of rising interest rates and the prospect of a modest recession, global concern over cybersecurity has never been higher. In response to the increased frequency and severity of cyber attacks, organizations are planning to increase their cybersecurity spending in 2023. According to ESG Research, 65% of organizations have expressed their intention to boost their cybersecurity budget to address the growing threat.

Looking forward, M&A activity in the Cybersecurity & Infrastructure Services industry is expected to remain relatively resilient and robust. Continued investment from both financial and strategic investors is supported by the imperative for data security in an evolving threat landscape.

7MA has completed numerous M&A transactions in the Cybersecurity & Infrastructure Services industry and maintains unparalleled knowledge of industry and valuation trends as well as experience with the most active strategic and financial buyers. Please contact Leroy Davis or Sydney Scadden if you would like to learn more about Cybersecurity & Infrastructure Services.