May 2022

Market Update: Cybersecurity & Infrastructure Services Q1 2022

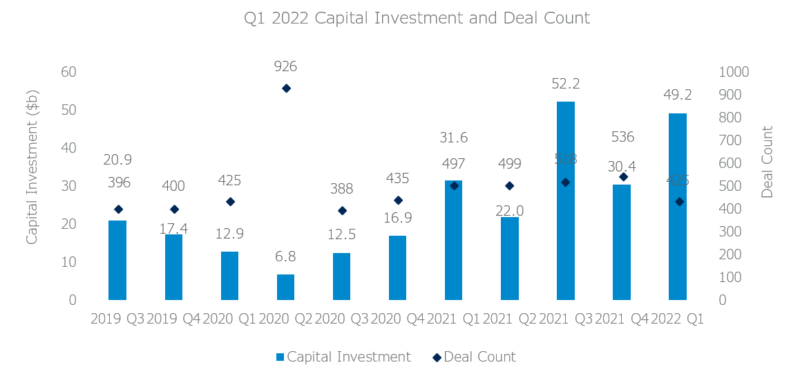

In Q1 of 2022, the global Cybersecurity & Infrastructure Services industry posted its second-largest quarterly capital investment at an incredible $49.2 billion, following the all-time highs of Q3 2021 which was $52.2 billion. Specifically, the quarter saw 425 M&A and Buyout/LBO deals globally, a roughly 20% decrease from the previous quarter’s number of deals. Additionally, the majority of the invested capital came in the form of venture capital funding (96 deals), which took place primarily in the United States, United Kingdom, Canada, and Israel.

Industry Challenges

Growing Demand. Covid has brought many changes to security markets, such as increased demand for mobile platforms and remote work increasingly hinging on high-speed access to ubiquitous and large data sets. With the growing migration to the cloud, enterprises are increasingly responsible for storing, managing, and protecting data and for meeting the challenges of explosive data volumes. For example, In 2020, on average, every person on Earth created 1.7 megabytes of data each second. Companies are not only gathering more data but are also centralizing them, storing them on the cloud, and granting access to an array of people and organizations, including third parties such as suppliers. The marketplace for web-hosting services is expected to generate $183.18 billion annually by 2026. Organizations collect far more data about customers — everything from financial transactions to electricity consumption to social media views — to understand and influence purchasing behavior and more effectively forecast demand. It is imperative leading security players keep up with said data demand, storage, and protection.

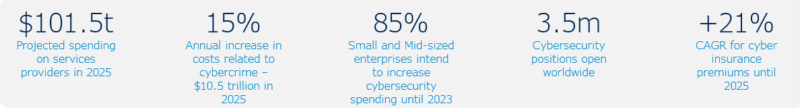

Hackers are becoming more sophisticated. Today, cyberhacking is a multi-billion-dollar market, containing institutional hierarchies and R&D budgets. Attackers use advanced tools, such as artificial intelligence, machine learning, and automation. Over the next several years, they will be able to expedite — from weeks to days or hours — the end-to-end, attack life cycle, from reconnaissance to exploitation. For example, Emotet, an advanced form of malware specifically targeting banks and the financial services industry, can change the nature of its attacks based on the defense mechanisms thrown at it and is being increasingly utilized amongst hackers globally. Concerningly, during the initial wave of COVID-19, from February 2020 to March 2020, the number of ransomware attacks in the world spiked by 148 percent, many of which were led by Emotet and malware alike.

7MA has completed numerous M&A transactions for companies operating in the aforementioned sectors and has developed unparalleled deal expertise and knowledge of the industry trends, valuation trends, and most active strategic and financial buyers. Please contact Leroy Davis, Sydney Scadden, Tomas Adduci, and/or Trent McCauley if you would like to learn more about Cybersecurity & Infrastructure Services.