The Economy & Counter-Cyclical Businesses

No matter if you’re enjoying a coffee with colleagues, a nurse in the midst of patient care, or dining with friends, the current state of the economy seems to be a recurring topic of conversation. Is it the length of the current expansion cycle? The recent volatility of the stock market? Or are there indications grounded in empirical data of an eminent downturn? Perhaps a combination of all three. Let’s dive right in.

Is it the length of the current expansion cycle?

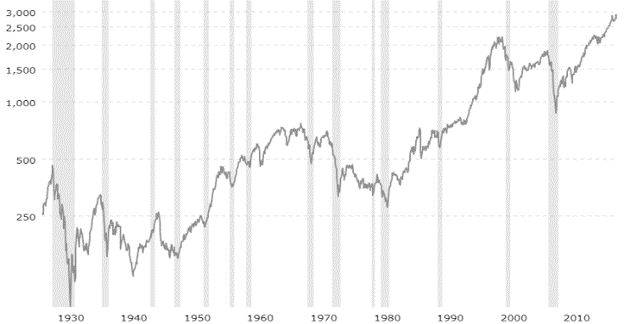

Depicted below is the S&P 500 Index adjusted for inflation from 1928 to 2018 where the gray lines depict each recession. As you can see, we’re currently in one of the longest growth cycles in modern history.

S&P 500 (adjusted for inflation)

Source: [1]

The recent volatility of the stock market?

The end of 2018 had the U.S. public sitting on the edge of their seats with more than one significant daily declines in the Dow and S&P 500 [2]. Followed by a start to December that was the worst since The Great Depression; not a comparison to be proud of [3]. The U.S. economy gave investors a rollercoaster ride, which in the short-term is a little unsettling. 2019 has proved to be a different story, but at this point in the cycle investors are watching the markets with more uncertainty.

Factual Indications Pointing to a Downturn?

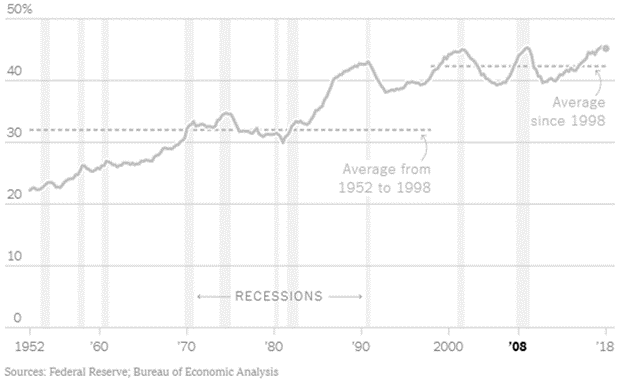

For starters, there’s a trend towards a fully inverted bond yield curve, a sign that investors are betting on the long-term over the short-term. A fully inverted bond yield curve is almost a sure sign of a recession in the near future. Beyond the yield curve, signs of high outstanding debt levels indicate additional concern. Corporations have high amounts of outstanding debt, specifically higher debt outstanding as a percentage of GDP, even compared to the last recession [4]. Companies have also taken out more debt relative to assets offering less loan safeguards to investors [5].

Corporate Debt % of U.S. GDP

Source: [6]

On the Other Hand…

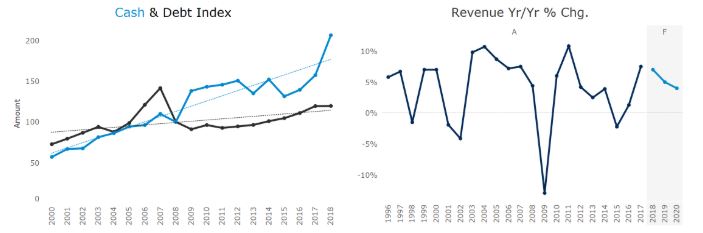

Even though there’s enough evidence out there to build a case for doom and gloom, nothing points in the direction of another ‘08 experience and there are several positive indications. Especially as it relates to the overall M&A landscape. 7 Mile has experienced valuations reaching all time highs as corporations have large amounts of cash on the balance sheet and look to deploy it via acquisitions. Not only are cash balances up for the S&P 500 as a whole, but revenue growth decelerated in 2018 after a strong year in 2017. This deceleration encourages organizations to supplement with inorganic growth therefore creating a strong and competitive M&A market. Average gross margins and EBITDA margins, excluding the last recession, are creeping higher and higher as well creating another sign of economic strength.

Source Data: [7]

Conclusion

So where does the U.S economy stand? Well the economy isn’t doom and gloom, but there are signs of a slowdown on the horizon. Some estimate that a recession will hit around 2020 or 2021 [8]. The signs don’t portray a recession as severe as experience in ‘08 and in the meantime there are also a lot of indications of a healthy market with a lot of M&A deal volume. Given our current situation of a strong market with reason for caution it seems that several firms have decided to seek out “counter-cyclical” capabilities to hedge the risk of a potential market downturn. What do I mean by counter-cyclical? Take for example a typical cycle as follows: a healthy economy and economic expansion. Capabilities around that period of the cycle would be focused on the positive (i.e. growth). On the contrary, a counter-cyclical business focuses on the negative (i.e. distressed situation).

We’ve seen a number of recent M&A transactions where organizations, under the assumption of a recession in the near-term, have acquired counter-cyclical businesses to offset their potential losses. As the cycle turns the counter-cyclical business ramps up offsetting potential losses of the business preying on the expansion cycle. Specifically in the business services space, a specialty area for 7 Mile Advisors, Turnaround and Restructuring advisory services flourish during down economic times. By nature the services these firms provide are in the instance that corporations are failing to meet loan covenants or financially distressed and a lender as well as other parties aren’t going to recoup their investment. As business slows during a recession, over-leveraged organizations struggle to meet covenants and therefore need the assistance of a Turnaround and Restructuring professional. LM+Co, a leading boutique Turnaround and Restructuring, Private Equity Performance Improvement and Corporate Finance firm is a primary example of a firm serving these end markets; they were recently acquired by BDO in an effort to expand BDO’s Advisory practice. Take these other examples:

Now in all of the transactions listed were the acquirors looking at the acquisition under this investment thesis? Possibly, and given the current market state it definitely made the investment more intriguing. As the U.S. economy potentially edges closer to uncertain times, we plan to keep an eye out for more deals in this space.

Footnotes: [1] - Macrotrends [2] - CNBC [3] - CNBC [4] - NY Times [5] - Crain’s New York Business [6] - Federal Reserve; Bureau of Economic Analysis [7] - S&P 500 [8] - Money