The impact of COVID-19 will be far-reaching and significant in both human and economic terms. To be sure, the impact to individuals and affected families cannot be minimized. We remain in the early phase of this pandemic in the U.S., and the situation is rapidly evolving and (most of all) unpredictable as governments and industries struggle to contain the virus’ proliferation.

While the virus will affect just about every aspect of the economy, sparking significant changes across industry verticals, we believe one of the most affected will be the insurance sector. Given the nascent state, the financial impact on the insurance industry is uncertain and cannot be easily quantified at this time. However, with the Insurance sector facing its greatest challenge since 9/11, the one thing that remains certain is that the industry will likely not be the same going forward.

Will the Industry Survive?

The short answer is “yes.” The National Association of Insurance Commissioners (NAIC) regularly assesses the financial health of the industry by analyzing each insurer’s Risk-Based Capital (RBC). This determines the capital appropriate for each business to support its overall operations, and limits the amount of risk a company can take. The NAIC then determines an RBC ratio, which is defined as:

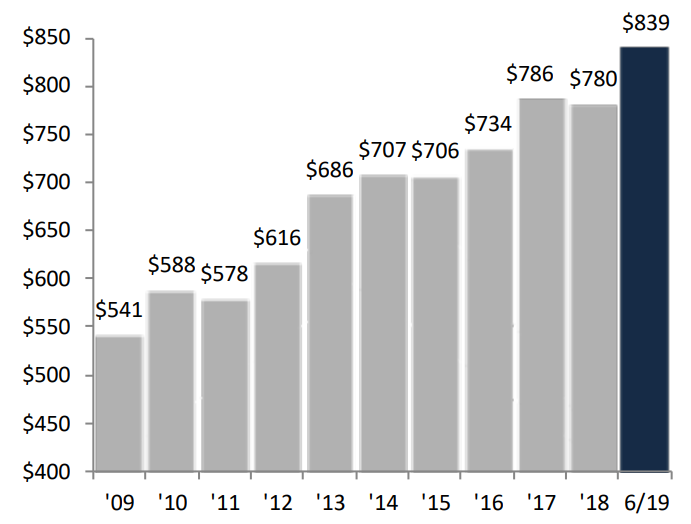

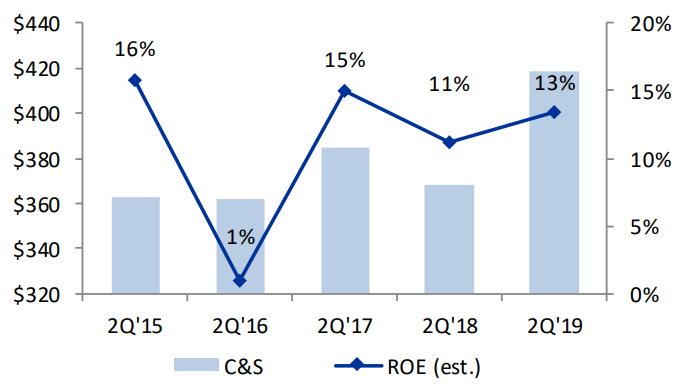

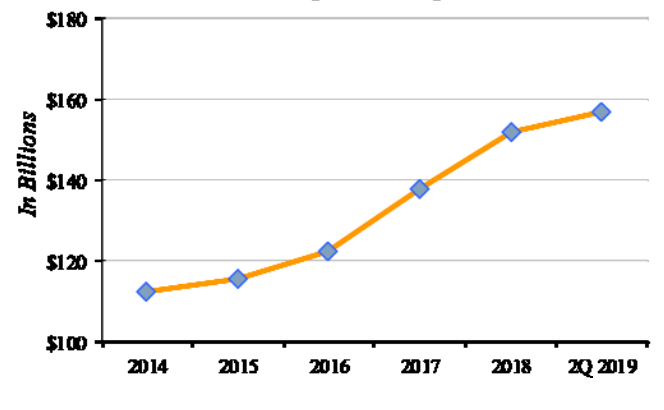

In other words, this ratio helps identify companies that are inadequately capitalized by dividing the company’s capital by the minimum amount of capital that the regulatory authorities feel is necessary to support the insurance operations. A ratio of 100% or greater is deemed to be satisfactory, while anything below 100% can trigger various regulatory or change of control actions. Heading into the current crisis, the insurance industry was well capitalized from a RBC standpoint with acceptable RBC ratios in Life (841%), Health (626%), and Property & Casualty (aka P&C; ~95% of insurers over 250%). All in, the industry is sitting at record levels of capital and surplus according to the NAIC 2019 Industry Snapshots.

Figure 1. P&C Capital & Surplus (billions)

Source: NAIC

Figure 2. Life and Accident & Health Capital and Surplus (billions) & ROE

Source: NAIC

Figure 3. Life Capital and Surplus (billions)

Source: NAIC

So What Are The Impacts?

While the insurance industry may be well capitalized to handle the influx of Coronavirus-related claims, the industry is certainly not entirely immune to COVID-19. At the moment, the prevailing opinion is that Life and Health insurers will be disproportionately impacted compared to their P&C counterparts. The most immediate impact will be an increase in morbidity and hospitalization; however, the magnitude of the financial impact is too early to ascertain.

Perhaps more pressing remains the risk of declining interest rates, which presents a challenge to the entire insurance industry, but will weigh more heavily on the Life Insurance and Annuity sectors that rely on interest-rate sensitive investments. On March 3, the Federal Reserve conducted its first emergency action since the recession in 2008, and lowered the federal funds rate by 50 bps, then cut it again to near zero on March 15. To address this, a number of Life and Annuity insurers were already in the process of adjusting their investment and product portfolios to account for historically low interest rates, and the current pandemic likely accelerates any pre-existing plans.

On the P&C side, volatility in the equity markets will cause frustration among P&C insurers which typically hold more liquid assets to settle claims in the event of a major catastrophe such as an earthquake or hurricane. So far, a number of the bond rating agencies have weighed in. Specifically, Fitch is in the process of reviewing its insurance ratings relative to assumptions with respect to the impact of the COVID-19 pandemic on capital markets volatility, interest rates, market liquidity and insured claims/reserves. However, the company stated that “near-term downgrades are possible but currently viewed as unlikely.” Similarly, Moody’s stated that global P&C commercial lines exposure is “limited with modest insured losses relative to economic losses.”

Overall, the ultimate dollar loss to the insurance industry will not be known for quite some time as primary insurance carriers, reinsurers, regulators, third party administrators, judges, lawyers, etc. wrestle over the finer details of which claims will be paid and determine the size of the payouts. Further, with courts closed for the foreseeable future, resolution is not likely to come soon. To complicate the issue, a number of states including Ohio, New Jersey, New York, and Massachusetts are considering new bills that would require all insurers to retroactively cover small business interruption (BI) claims, despite the fact that undefinable risks, such as pandemic, are typically excluded. As one former Property & Casualty insurance industry executive we spoke with expressed, “it will be a holy mess that the industry is understaffed to handle.”

What’s Next?

The Insurance Information Institute reported that “COVID-19’s impact on global growth and the insurance industry is likely deeper and wider than the current consensus and could last well into the third quarter and beyond.” We concur and add that the changes to the industry will not be limited to the financial, underwriting or regulatory realms, but will be much more far reaching in scope.

Like a number of industries, insurance carriers and ancillary service providers will need to ensure business continuity while minimizing disruption to clients. In the immediate term, this will require insurers to rely on mobile solutions to keep employees connected in the absence of a shared physical office. Additionally, employees that traditionally rely on physical inspections such as claims adjusters and certain medical professionals (collecting blood samples for example) will need to implement new safety procedures or leverage new digital tools/apps to complete their work.

Overall, 7 Mile Advisors believes the mass disruption to the industry brought on by COVID-19 will highlight businesses that are furthest along in their digital transformation journey. The Insurance industry tends to be conservative with massive national brands, products, processes, and underwriting methodologies that have not changed significantly in decades, and we believe the current situation could provide the spark that will ignite dramatic industry-wide change.

As the political and economic climate changes day by day, we continue to learn and adapt, and encourage anyone with questions to reach out. Our team may be working remotely, but we are very much engaged and welcome continued conversations on this topic or others. Please reach out to Nick Prendergast (nicholas@7mileadvisors.com) with questions.

This blog was created by Nicholas Prendergast.

Blog Series: The Impact of COVID-19

The COVID-19 pandemic is impacting people across the world in their homes, in their offices, and in their wallets. With political turmoil, market uncertainty, and a general sense of fear at the forefront of many American’s minds – we at 7 Mile are consistently being asked the questions, “what does this mean for your business” and “what does this mean for my business.”

As a result, over the next couple of weeks, we will be releasing our COVID-19 blog series, which dives deeper into those two key previously mentioned questions for each of the industry verticals that we cover. The first post in the series addressed the COVID-19 impact within the Consumer Ecosystem. We welcome feedback and questions, as we continue through the series.

About 7 Mile Advisors

7 Mile Advisors provides Investment Banking & Advisory Services to the Business Services & Technology Industries globally. 7 Mile Advisors advises on M&A and private capital transactions, and provides market assessments and benchmarking. As a close-knit team with a long history together and a laser focus on our target markets, 7 Mile Advisors helps its clients sell companies, raise capital, grow through acquisitions, and evaluate new markets. For more information, including research on the M&A markets, visit www.7mileadvisors.com.