October 2022

Market Update: IT Services & Software in Latin America Q3 2022

Despite political concerns and the stock market downturn, the capital invested into the Latam economy are at historical levels. Venture Capital deals account for 70% of the transactions, followed by 20% from M&A and 10% from Private Equity. Internet penetration in Latam has surpassed that of China and India, and investors believe it will continue growing in the coming years. Despite market turbulence, top university talent continues to seek technology jobs, allowing foreign companies to satisfy their local lack of workforce. These ‘tech hubs’ and the regions’ attractive policies for the IT Services sector create a captivating scenario for companies despite the discrepancies in the market. Moreover, the provided workforce allows companies to reduce costs and to maintain competitiveness in the market.

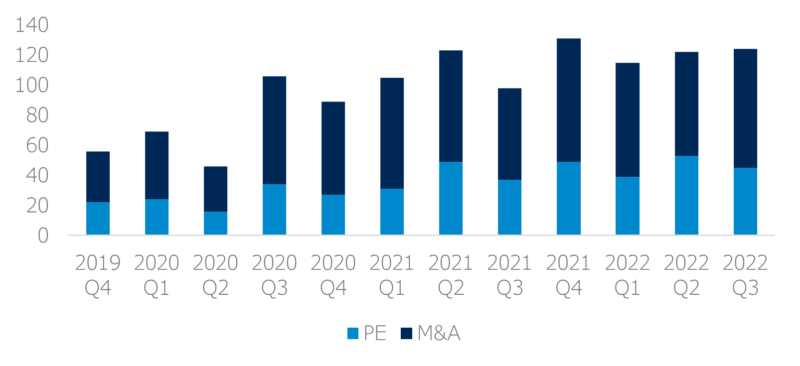

The high volume of transactions and the levels of investment in the IT Services and Technology sector continue to increase its presence in the Latam market. M&A transactions remain constant in Q3 (50 deals) compared to Q2 (49 deals), and the industries leading these trends are Financial Services and TMT. The increase in Fintech investment is due to the lack of banking and the high level of cash transactions (<50%) managed by the customers. Also, it became an attractive alternative for banks to diversify their portfolio and penetrate new regions with high growth potential. Brazil and Mexico are leaders in the fintech space and receive funding from investors outside the region. The conflicts in Europe, plus the high cost of the market, create an opportunity for Latam companies to become centers of business.

Brazil remains the region with more deals, followed by Chile, Argentina, and Mexico. The transactions in Q3 were made in verticals like Fintech, TMT, SaaS, Artificial Intelligence, e-commerce, Mobile, and IoT. Investors believe M&A activity will keep going at this pace, and countries like Uruguay, Argentina, and Chile will become active players in the next quarter.

7MA has completed important M&A transactions for companies with outsourced operations and/or delivery centers in Latin America and has developed unparalleled deal expertise and knowledge of the industry trends, valuation trends, and most active strategic and financial buyers. Please contact Horacio Yenaropulos or Kevin Postigo if you would like to learn more about the landscape in Latin America.