July 2022

Market Update: IT Services & Software in Latin America Q2 2022

Latin America’s IT Services sector continued upon trends that began in 2020, entering into an unprecedented tech and tech services boom, as private capital is being heavily infused into the region. Q2 2022 was characterized by rising inflationary pressures and recessionary fears worldwide as the Russia-Ukraine turmoil in Eastern Europe has caused markets to trend starkly downwards. The US Fed hiked up interest rates in an attempt to combat rising inflation, but markets continue trending downward with a looming uncertainty, causing valuation multiples to also drop. However, these rising global economic concerns enable opportunity for LATAM as various companies have identified the region as a means to lower costs and maintain higher margins. The FinTech sector has already set a precedent for M&A investment in LATAM and other sectors will likely grow in the region as a consequence of global economic fears.

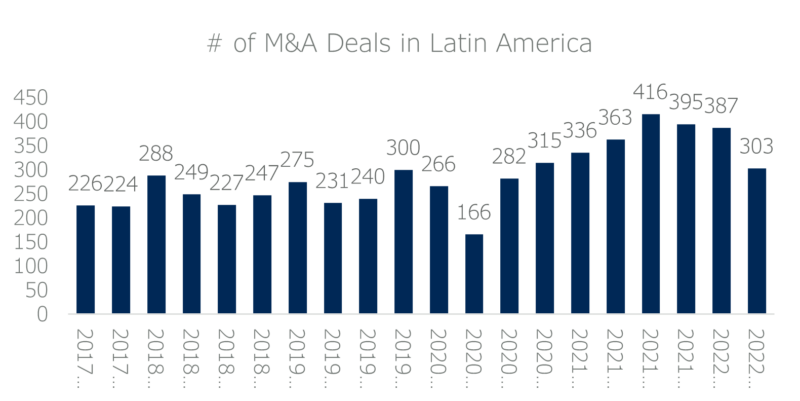

Q2 saw a total of 303 related M&A deals across a myriad of associated verticals, exhibiting a slight decline YoY because of the macroeconomic situation described. Deal flow was mainly focused in the FinTech, SaaS, Business and Productivity Software, and E-Commerce sectors. Similar to Q1, there was a geographic concentration of M&A deal activity in Brazil, along with Chile, Colombia, Mexico, and Argentina.

Many companies in the Americas have identified the LATAM region as a cost-effective and valuable nearshore center for delivery, production, and innovation. This has enabled the growth of the tech services space within LATAM, as strategic buyers and private equity firms, especially from Southeast Asia continue to invest private capital into the region.

For example, the FinTech sector continues to pose a huge investment opportunity from outside investors, as the region is poised to be an emerging leader in the global FinTech space. Brazil and Mexico particularly have taken the spotlight, as FinTech investment has starkly accelerated within the two nations. With evolving consumer preferences and the rise of outside capital being invested, LATAM is on the brink of rapid growth within FinTech and the IT realm as a whole.

7MA has completed important M&A transactions for companies with outsourced operations and/or delivery centers in Latin America and has developed unparalleled deal expertise and knowledge of the industry trends, valuation trends, and most active strategic and financial buyers. Please contact Horacio Yenaropulos or Kevin Postigo if you would like to learn more about the landscape in Latin America.