January 2023

Market Update: Insurance Services & Technology Q4 2022

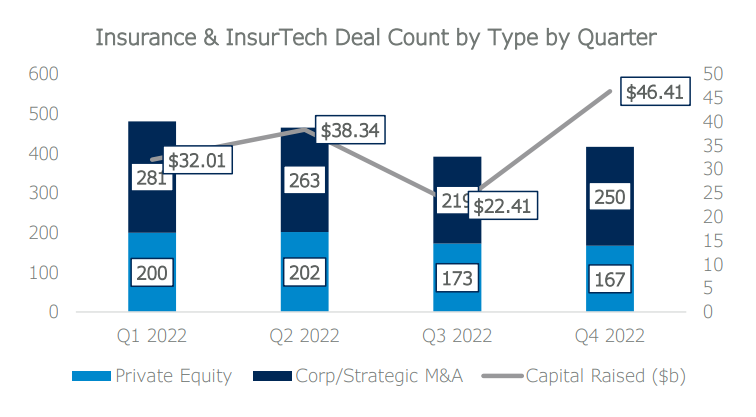

Global M&A activity in the Insurance Services and Technology ecosystem ended 2022 on a slightly high note, with the number of transactions slightly eclipsing Q3 totals as investors and sellers alike continue to prioritize completing transactions to accelerate inorganic growth opportunities. This quarter did present a large spike in total transaction value, led by Optum’s $13b acquisition of Change Healthcare, as well as Berkshire Hathaway’s $11b acquisition of Alleghany. The continuance of “mega deals” has shown that investors are starting to gain slightly more comfort while navigating uncertain economic conditions.

Looking ahead to Q1 2023 and beyond, investors will be keen to understand how the public market and economic performance of 2022 will impact the M&A markets going forward. As for the Insurance Services landscape, large carriers and brokers alike likely will continue to look towards inorganic growth opportunities as a way to enhance the way in which they engage their customers and the channels that are used to do so as Insurance continues its slow but sure adoption of technological services, solutions, and products.

7MA has completed and is constantly working on numerous M&A transactions with companies that operate in the Insurance and Insurtech industry. Our team has developed unparalleled deal expertise and knowledge of the industry trends, valuation trends, and the most active strategic and financial buyers. Please contact Nicholas Prendergast, Steve Buffington, or Adam Alderfer if you would like to learn more about 7MA’s Insurance Technology and Services practice.