The Blueprint – November 2021

Over the past several decades a modern industrial revolution has emerged, referred to by the common moniker, “Industry 4.0.” At its foundation, Industry 4.0 is the digitalization of manufacturing and tangent industries, bolstered with help of ongoing tech advances in the form of interconnectivity through IoT, access to real-time data, and the introduction of cyber-physical systems. It offers a more complete, intertwined, and holistic approach for manufacturing. Industry 4.0 is not only about investing in new technology and tools to improve manufacturing efficiency, but also about revolutionizing the way businesses operate and grow.

The possible capabilities from implementing and adopting Industry 4.0 continue to evolve as industrial IoT and automation technologies rapidly progress. For example, many companies impacted by Industry 4.0 today are realizing the benefits of creating connectivity among machines and adding operating nodes to collect massive amounts of data. Data connectivity combined with advances in data analytics capabilities are providing the ability to make automated decisions in a fraction of the time capable by humans and helping companies address areas of concern before they become too large to correct. Similarly, the use of robots to perform mundane tasks that are allowing human capital to focus on value-added, non-autonomous functions has become widespread, where previously this was an area of adoption that only a select few companies with sufficient budgets could implement.

As more and more companies adopt Industry 4.0 technology and practices and the economy continues to recover from the pandemic, Meticulous Research is predicting that the Industrial IoT market will grow at a CAGR of 16.7% from 2020 through 2027, and ultimately reach a value of $263.4 billion. In this market, the Manufacturing industry will own the largest share, largely due to the continuous need to reinvest in IoT solutions in order to operate as efficiently as possible. However, the Healthcare industry is the one most likely to grow the fastest over this same period, thanks largely to companies having to adapt to a new ecosystem.

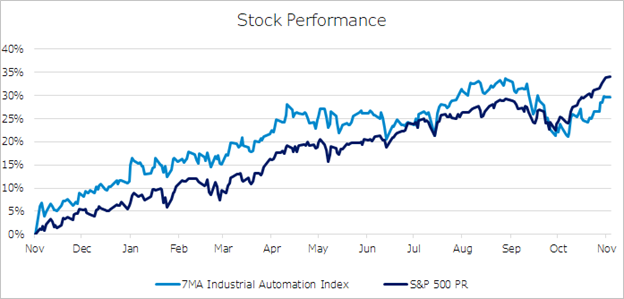

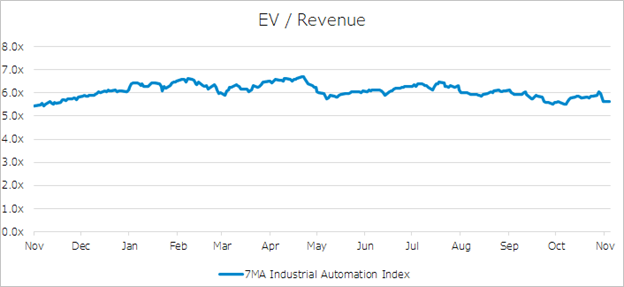

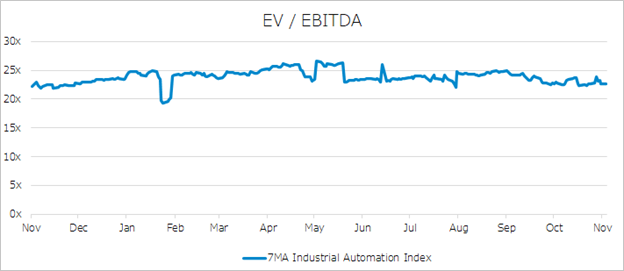

Industrial Automation stock performance measured by 7MA’s sector index has grown approximately 23% over the last twelve months. This sector index was performing in line with the overall market through September, but has since lagged behind the market as continued global supply chain constraints negatively impact the Industrial Automation market. Over the last twelve months, average sector revenue multiples have stayed between 5.4x – 6.7x, and are currently at 5.6x, slightly below the 6.1x average over the period. EBITDA multiples have been around 19.4x – 26.6x over the past twelve months, and are currently at 22.6x, also slightly below the period’s average of 23.8x.

The Download

The best articles from around the web for AEC industry leaders.

- What is Industry 4.0? via Epicor

- Industrial IoT Market Projections via Meticulous Research

- What is Industry 4.0? Here’s A Super Easy Explanation For Anyone via Forbes

Transaction Talk

Insights and intelligence on recent notable industry transactions.

Cosmetics giant Estée Lauder has acquired Inther Group, an international system integrator headquartered in the Netherlands, to implement the Gantry Robotic Intelligent Piece Picker (“GRIPP”). Inther specializes in developing complete intralogistics solutions that address the increasing complexity of this industry. Many available hardware solutions no longer meet the complex intralogistics requirements. GRIPP is a fully automated, compact picking technology and can process up to 1,200 pieces per hour. Estée Lauder plans to integrate the robot into its picking activities area to further increase capacity and speed for e-commerce order fulfillment and at the same time reduce manual labor, as well as respond to online orders quicker and more efficiently.

Symphony RetailAI, a leading global provider of integrated AI-powered marketing, merchandising, and supply chain solutions for fast-moving consumer goods retailers and manufacturers, has acquired ReTech Labs, a developer of AI, robotics, and computer vision technologies intended to build innovative and scalable solutions. Through this acquisition, Symphony RetailAI will be able to deliver more value to grocery retailers and CPG suppliers.

Lucas Systems, a leading provider of voice and warehouse optimization software for fulfillment and distribution centers, and Fetch Robotics, a Silicon Valley-based Robots-as-a-Service (“RaaS”) provider, have announced a partnership agreement with the goal of optimizing collaboration between warehouse workers and robots. In this partnership, Lucas Systems will provide end-users of Fetch’s AMRs with an AI-based warehouse optimization software that aggregates order, inventory, and location data from other systems and uses it to generate instructions for workflow optimization in real-time.

About 7 Mile Advisors

7MA provides specialized Investment Banking & Advisory Services to the professional service firms in the Consumer Products & Retail industries. We help our clients determine the right strategic partners for their businesses, transition ownership, raise capital, grow through acquisitions, and evaluate new markets. We advise our clients on M&A and private capital transactions, and provide unique market insights. Our team brings experience and energy to all of our engagements, with a focus on helping our clients navigate a changing marketplace.

To learn more about how 7 Mile Advisors can help you evaluate and execute on strategic M&A or private capital alternatives for your business, please visit our website www.7mileadvisors.com.