As IT Services specialists, 7 Mile Advisors works very closely with middle-market IT services companies, their publicly traded peers and competitors, private equity investors, vendors, channel partners, and various other stakeholders. Our multifaceted, ongoing interaction and engagements offer a unique vantage point as we analyze prospects for growth in specific market segments. As such, we have identified the following areas within IT Services as holding great promise.

Digital Transformation

By Digital Transformation, broadly, we mean the design and development, or integration and application of digital technology into most or all components of a business in such a way as to transform operations from antiquated systems and processes to more interactive, technologically innovative approaches to how a company conducts business. Particular areas of interest and coverage span from Web and Mobile Application Development to Cloud Services, AI (Artificial Intelligence), Analytics, RPA (Robotic Process Automation), and IoT (Internet of Things).

There is a need for all businesses, large and small, to implement and use digital technologies to improve processes and performance. This universal requirement has created a substantial backlog of work for IT Services companies with expertise in Digital Transformation, leading to high growth. This market shift has also created the opportunity for Service Providers to differentiate themselves through the use of proprietary IP, plug-ins, tools, accelerators, etc., as well as through domain and vertical expertise – thereby, adding unique value to clients. Examples of Digital Transformation taking effect are found in migrations from traditional IT environments to cloud or hybrid infrastructures, allowing for more nimble and scalable hosting. Other examples include leveraging behavioral analytics as a business identifies opportunities to personalize digital marketing efforts, and the automation of highly repetitive tasks through the use of RPA technologies. Some Digital Transformation projects can be completed relatively quickly, but to totally transform a business can take years of implementing many components required for fundamental change. Additionally, there exists a constant need to upgrade systems, especially as technology cycles now occur at an increased pace and with greater frequency. All these factors create significant long-term growth prospects for Service Providers and Solution Providers alike. It’s noteworthy that Market Research Engine forecasts Digital Transformation to grow at the aggressive CAGR of 18.5% through 2024. (1)

This background of market growth has also fostered increased M&A activity, with several notable headline transactions and an abundance of smaller, niche tuck-in acquisitions being completed recently. Some of the largest deals include: the acquisition of Softvision by Cognizant, Endava’s IPO, and DXC’s acquisition of Luxoft. In 2018 alone, 7 Mile closed the following 11 Digital Transformation deals:

For more on activity within Digital Transformation, please see 7 Mile’s blog “Digital Consulting – Tip of the Spear to A Successful Digital Transformation.”

Managed Services

We continue to see a strong demand for Managed Services Providers (MSPs) from both an M&A standpoint as well as market demand for new, innovative MSP offerings as MSPs retool and specialize to deliver more business-solutions-oriented results such as data management – leveraging analytics, application optimization, etc. The ability for businesses to lean on MSPs for these critical needs has forced MSPs to evolve. Investors and acquirors alike are attracted to the operating leverage, revenue visibility, and ability to automate tasks associated with this business model.

Proactive monitoring of IT infrastructure from servers and networks, to middleware and applications, in order to pre-emptively identify and resolve issues represents a sound entry point into Managed Services for a Solutions Provider. Additionally, monitoring server event logs, ensuring proper updates, properly backing up data, preventing bottlenecks, running application services, and providing remote helpdesk support, remain mission-critical needs.

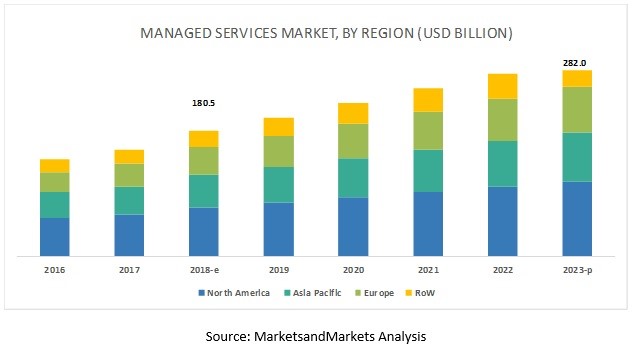

Managed Hosting can be more technologically challenging and capital intensive to implement, but also represents an appealing opportunity to become closely intertwined in a customer’s IT infrastructure and to create a “sticky” customer relationship. Managed Hosting entails a Solutions Provider installing the hardware and/or software, and managing it by offering monitoring services, technical support, patch management, maintenance, and updates. Overall, Managed Services are growing at a CAGR of 9.4% through 2023 – arriving at a total value of $282B U.S. dollars in that year – according to a study conducted by Markets and Markets. (2)

Managed Security Services

Solution-specific Service Providers in a growing market have attracted particular interest – enter Managed Security Providers. Managed Security can include intrusion protection such as firewalls, antivirus and spam filtering, proactive scans, data backup and recovery, patch management and upgrades, security assessments and audits, and emergency support. The complexity and sophistication required to be a first-rate provider of Managed Security Services allows an opportunity for differentiation through expertise and IP. This is one of the more attractive areas of growth for MSPs, as the space is growing at a CAGR of 14.5% through 2024 according to Market Research Engine. (3)

The attraction of this segment is reflected by some of the larger MSPs making a push into Managed Security in 2018, highlighted by the following transactions:

- All Covered acquired VioPoint

- Trilogy Technologies Group acquired Zinopy Security

- GreenPages acquired Norwell Technology Group

- Six Degrees acquired CNS Group

Managed Cloud

Cisco estimates that by 2021 over 94% of workloads will be running in a cloud environment, and the growth of Managed Cloud Services through 2025 stands at a CAGR of 15.4%, according to Grand View Research. (4) We can confirm through our work, deals, and firsthand experience, that MSPs with a focus on providing Managed Cloud Services, or stand-alone Managed Cloud Providers, are well positioned to take advantage of this mass migration to the cloud. It’s interesting to examine some of the larger players in this space according to Gartner’s quadrant of industry leaders below.

(5)

(5)

Planning & Looking Ahead

Partnering with leading IT organizations as a strategic advisor has afforded 7 Mile Advisors deep domain expertise. We leverage our experience, research, and processes to help IT Services companies execute their strategic roadmaps related to mergers or acquisitions, capital raise transactions, or other strategic advisory-oriented engagements. The growth areas we have outlined are only a snapshot of our research and views on the space, but certainly represent some of the hottest pockets of growth in the ever-changing IT Services landscape.

Sources:

- https://www.marketresearchengine.com/digital-transformation-market

- https://www.marketsandmarkets.com/PressReleases/managed-services.asp

- https://www.marketsandmarkets.com/PressReleases/managed-security-services.asp

- https://www.grandviewresearch.com/industry-analysis/cloud-managed-services-market

- https://www.gartner.com/doc/3870075/magic-quadrant-public-cloud-infrastructure

About 7 Mile Advisors

7 Mile Advisors provides Investment Banking & Advisory Services to the Business Services & Technology Industries globally. 7 Mile Advisors advises on M&A and private capital transactions, and provides market assessments and benchmarking. As a close-knit team with a long history together and a laser focus on our target markets, 7 Mile Advisors helps its clients sell companies, raise capital, grow through acquisitions, and evaluate new markets. For more information, including research on the M&A markets, visit www.7mileadvisors.com.

All securities transactions are executed by 7M Securities, LLC, member SIPC/FINRA.