M&A Activity in IT Services and Software Sector in Romania is Expected to Accelerate in 2021.

By Ilia Ulianchuk | May 10, 2021

Many companies in Western Europe and North America have already outsourced their IT services to Romania, one of the top European software outsourcing destinations. The abundance of professional, multilingual talent, at the right price-to-quality ratio, makes IT outsourcing to Romania an advantageous long-term business decision. For these reasons, 7 Mile Advisors is seeing additional M&A activity and organic expansion across Romania. Our firm is active in the Central & Eastern European region and believes the M&A activity in Romania is expected to accelerate this year due to the increasing appetite from investors for IT companies in this country and the desire to pursue and integrate digital technologies via M&A.

Source: Wikipedia, World Bank, PayScale

Overview

The Romanian IT industry has been growing at a fast pace for 20 years and is now stable and substantiated. As a result, there are many midsize and small-sized enterprises serving small and medium enterprises (from the U.S., Germany, France, the United Kingdom, and Italy) that wish to outsource custom software development and IT projects. The country became an EU member on January 1st, 2007, making it easier to travel and work with Romanian IT and software companies.

Source: Google Images

Location

Romania has an incredibly attractive location. There is just a 2-hour time difference from other European countries, a 5-hour time difference from New York, and a 10-hour from San Francisco. This makes communicating across the time zones much easier. There are regular direct flights to most of the major European capitals, and access to the U.S. with one layover. Most Romanian IT services and software companies are based in Bucharest, Cluj-Napoca, Timișoara, and Iasi.

The Culture

Romania also has a European culture and civilization. Romania has strong traditions, yet follows western values. Cities are modern and heavily influenced by English since the introduction of English as a subject in schools.

Education

The education system in Romania does not just produce a great number of graduates, but it also develops highly skilled professionals, which is the strength of the Outsourcing industry and more so for technology services. Approximately 10,200 IT students graduate from 49 public universities and 8 private universities annually.

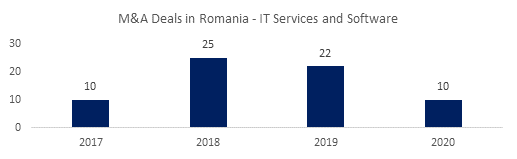

M&A Activity Overview

According to EY, the Romanian M&A market was affected by the COVID-19 pandemic, which generated delays or transaction freezes. Despite witnessing a significant slowdown in the first part of 2020, an unexpected come-back took place in the second half of 2020. Big Four firms KPMG and PwC have both released their forecast for Romania’s M&A market in 2021, and their findings are largely in sync – despite the continuing pandemic, healthy transaction numbers are in the cards this year.

The expected increase in M&A activity comes as nearly two-thirds (62%) of executives believe that their organizations must radically transform their operations over the next two years, according to the EY Digital Investment Index. To achieve that, they are starting to turn to emerging technologies, with the Internet of Things (IoT), Artificial Intelligence (AI), and Cloud Computing among the most likely investments in the next two years (67%, 64%, and 61%, respectively). With 52% of executives who pursued digital technologies via M&A saying that the approach exceeded expectations and 45% reporting similarly for digital partnerships, 2021 is set to see an increase in deals, corporate venture capital, and partnership investments.

Source: Pitchbook Data

According to EY, with 79% of U.S. companies indicating that they are likely to accelerate M&A strategies, alliances and joint ventures if corporate tax rates increase following the presidential election, the foundations are there for 2021 to be a stronger year for M&A.

Notable M&A Transactions

April 2021 : Wipro Acquires Metro Systems – IT services major Wipro announced it has completed the takeover of Metro-NOM GMBH and Metro Systems Romania SRL for $63m as part of its digital and IT partnership deal with Metro AG.

Februrary 2021: Orion Acquires Tellence – New Jersey-based Orion Innovation, backed by private equity firm One Equity Partners (OEP), has acquired Tellence Technologies, a technology services company headquartered in Bucharest, Romania. Tellence, founded in 2012, develops digital technologies for companies in telecommunications and media, cybersecurity, and other industries. Financial terms of the deal were not disclosed.

January 2021: ThoughtWorks acquires Gemini – Global software consultancy ThoughtWorks, backed by private equity firm Apax Partners, has acquired Gemini Solutions, a privately-held software development and consulting services firm from Silicon Valley. Terms of the deal were not disclosed. Gemini Solutions was founded in 2005 and delivers software and product development services. The company has more than 170 employees, including software engineers and operations staff based in Romania.

November 2020: Ratiodata acquires Accesa – German technology group Ratiodata has acquired Romanian digital services company Accesa for an undisclosed sum. Ratiodata AG is one of the largest system houses and service providers for banking technology and document digitisation in Germany with around 1,400 employees in 14 locations, and branch offices nationwide.

June 2020: Brillio acquires Cognetik – In an effort to expand its analytics offering, Silicon Valley-based digital technology consulting and solutions firm Brillio, backed by Bain Capital, has acquired Cognetik for an undisclosed sum. Cognetik, headquartered in Cary, North Carolina, provides data and insights with an eye toward improving digital experiences for its customers. Key clients include Facebook, Pizza Hut, and McDonald’s. The company has additional offices throughout the United States and in Romania.

Conclusion

Based on current conversations with global investors and strategic buyers, 7 Mile Advisors sees an increased interest in Romanian IT services and software companies. Our team observes spiked interest in transactions, both on the buyside and sellside, will continue in 2021.

7MA Experience

7 Mile Advisors acted as the exclusive sellside advisor to Kalypso in their sale to Rockwell Automation. Kalypso offers a full suite of consulting, digital innovation, enterprise technology, and business process management services that enable the transformation of product design and development, production management, and client service models. Kalypso has offices in the U.S. and Romania.

7MA has completed numerous M&A transactions for companies with outsourced operations and / or delivery centers in Eastern Europe and has developed unparalleled deal expertise and knowledge of the industry trends, valuation trends, and most active strategic and financial buyers.

7MA Central & Eastern European Deal Experience

About 7 Mile Advisors

7 Mile Advisors provides Investment Banking & Advisory Services to the Business Services & Technology industries globally. 7 Mile Advisors advises on M&A and private capital transactions, and provides market assessments and benchmarking. As a close-knit team with a long history together and a laser focus on our target markets, 7 Mile Advisors helps its clients sell companies, raise capital, grow through acquisitions, and evaluate new markets. For more information, including research on the M&A markets, visit www.7mileadvisors.com.

Subscribe to receive newsletters and industry research, as well as details about recent transactions, new podcast episodes, and upcoming events:

Sources

- Why IT Outsourcing with AROBS?

- Why Romania

- All You Need to Know About IT Outsourcing to Romania

- Will Your Digital Investment Strategy go from Virtual to Reality?

- Conditions Ripe for Already Resilient M&A Activity to Accelerate in 2021 and Beyond

- KPMG and PwC Predict Romania’s M&A Market to Pick Up

- Conditions Ripe for Already Resilient M&A Activity to Accelerate in 2021 and Beyond

- German IT Group Ratiodata Buys Romanian Digital Services Provider Accesa

- ThoughtWorks Acquired Gemini Solutions for European Growth

- Orion Innovation Acquired Technology Services Firm Tellence

- Digital Solutions Provider Brillio Acquires Cognetik for Analytics Push