January 2023

Market Update: IT Services & Software in Latin America Q4 2022

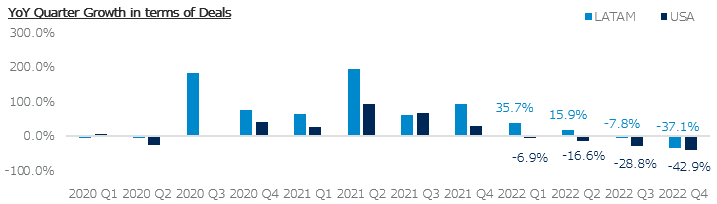

Despite the macroeconomics concerns, LATAM continues to strongly perform within the IT Services sector. Although it was a difficult year for the market (the S&P index was down 19.4% – the worst since 2008) there were 438 IT Services M&A deals completed in LATAM. This is only slightly down from the previous year (448 deals). LATAM outperformed expectations compared to other regions. The chart below illustrates how the LATAM region (-2.3%) surpassed the US deal output (-24.6%) from a year-over year percentage basis during 2022.

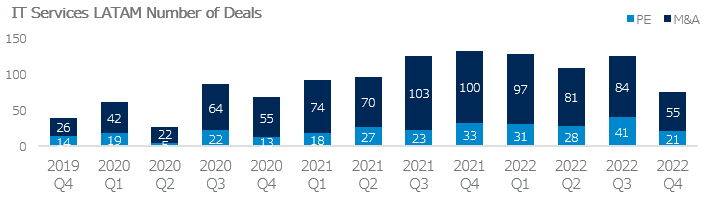

In addition, despite the slight drop in the number of deals transacted, the capital invested in the region increased year-over-year. In 2022, a total of $17b was invested in the region compared to 2021’s $7b. The most notable difference was identified in the amount of capital raised which was 180.0% higher than the previous year. During Q4, a total of 76 deals were closed, marking the lowest deal volume quarter of the year. Of the 76 deals 73% were comprised of M&A transactions and the remaining 27% were comprised of PE deals.

2022 showed that companies keep innovating their offerings to remain competitive in a growth market. Top university talent continues to seek technology jobs, allowing foreign companies to satisfy their local lack of workforce. Additionally, Fintech investment grew due to the lack of banking and the high level of cash transactions (<50.0%) managed by local customers.

Investors are cautious in their investment thesis and opt for companies in LATAM with attractive product offerings. A driving factor in successful LATAM transactions is a majority concentration of US or Europe-based clients serviced by the LATAM provider (80+% of the client mix). This criterion is driving investors’ investment appetite, and this pattern is expected to continue throughout the next year since the region continues to experience political and economic stressors.

During the calendar year 2022, Brazil leads the region in terms of number of deals followed by Chile, Argentina, Colombia, and Mexico.

7MA has completed important M&A transactions for companies with outsourced operations and / or delivery centers in Latin America and has developed unparalleled deal expertise and knowledge of the industry trends, valuation trends, and most active strategic and financial buyers. Please contact Horacio Yenaropulos if you would like to learn more about the landscape in Latin America.