May 2023

Market Update: IT Services & Software in LATAM Q1 2023

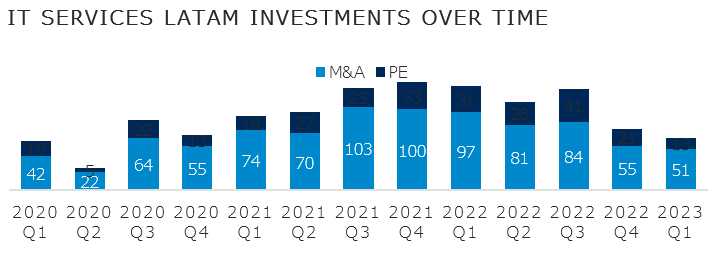

Macroeconomic and political turmoil had an impact on the LATAM IT Services sector in Q1 2023. Interest rate hikes and changes in some countries’ governments in the region led to slower Q1 activity compared to the last few years. This marks the second consecutive decrease in deal count and is strongly correlated with global economic instability. Despite the macroeconomic environment, the sector still presents great opportunities, and LATAM is a top target for global investors looking to deploy capital to expand their nearshore offerings with top local delivery centers.

Given that the majority of companies in LATAM are SMEs that heavily depend on VC or PE funding, the collapse of Silicon Valley Bank has had a significant impact on the region. Tech startups are struggling to find banking alternatives after the sudden crash of the mentioned bank. In addition, investors were more cautious during the first part of March, waiting for the FED’s answer, which finally decided to bail out its depositors, avoiding a bigger crisis.

Long-term strategic investors (51) are generating a larger share of deal activity than financial sponsors (13), making PEGs evaluate other ways of financing their operations. Accordingly, debt financing is becoming a popular option among these funds, as well as earn-outs and other forms of deferred consideration.

LATAM’s educative policies and English-speaking talent pool continue to be the main sources of attraction for foreign investors. Additionally, the time difference and low-cost workforce allow IT Service companies to complement their offerings while solving the issue of tech resource scarcity.

Investors’ investment theses are becoming more selective in their search for nearshore investments. Driving factors for Strategics and PEGs are companies that have a majority concentration of U.S. or European-based clients serviced by the LATAM delivery centers (+80% of the client mix), recurring revenue above 50%, and a billable workforce over contractors. This criteria is expected to continue throughout the next months due to the region’s continued political and economic stressors.

7MA has completed important M&A transactions for companies with outsourced operations and/or delivery centers in Latin America and has developed unparalleled deal expertise and knowledge of the industry trends, valuation trends, and most active strategic and financial buyers. Please contact Horacio Yenaropulos if you would like to learn more about the landscape in Latin America.