October 2021

Market Update: Digital Marketing & E-commerce – Q3 2021

The Digital Marketing & E-commerce M&A markets remain hot as buyers and investors continue to strive to capitalize on the market tailwinds of consumer behavior. Given the evolution of consumer behavior over the past year, we expect to be increased interest in M&A in this sector.

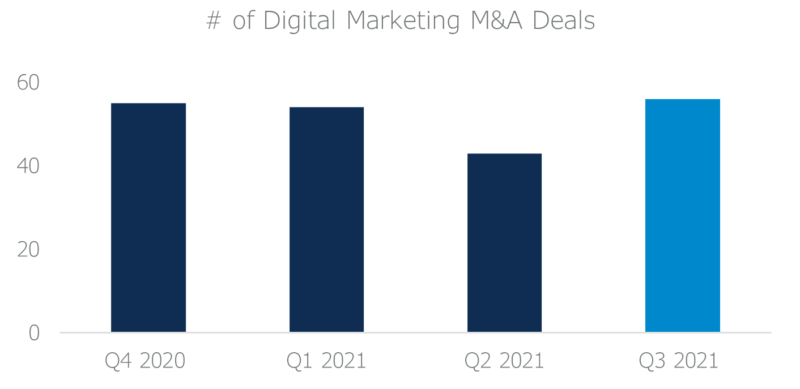

The third quarter recorded 57 deals; a robust 32.5% increase compared with the second quarter of 2021. Deal volumes and valuations remain high as strategic and financial buyers remain aggressive in acquiring digital marketing and E-commerce service providers.

The E-commerce industry continues to break records due to technological and logistical advances, trust and comfort of customers, contactless payments, and a mobile-driven world. The top three US retail companies seeing E-commerce growth in Q3 2021 are Etsy, Walmart, and Chewy, with Amazon placing fourth at 24.9% YoY growth. Amazon is expected to make $386.4b this year in E-commerce, more than the rest of the top 10 US retailers combined thanks to its superior selection, price, and delivery services.

The Q3 Digital Advertising sector is healthy and active as the economy recovers. The growth of E-commerce and improving production logistics brings more businesses into the digital space anticipating strong growth in the U.S., with a 12.6% increase in ad spending this year and a 9.5% increase in 2022. Digital advertising will continue to expand due to the strong return of brand advertising and demand for newer digital advertising channels such as retail media. SEOs remain the most significant digital channel, rising a 49% YoY.

7MA has completed numerous M&A transactions for companies with digital marketing and E-commerce service providers. 7MA has developed unparalleled deal expertise and knowledge of the industry trends, valuation trends, and most active strategic and financial buyers. Please get in touch with Mark Landry, Sydney Scadden, or Lucas Cerbelli if you would like to learn more about Digital Marketing & E-commerce.