May 2023

Market Update: Digital Engineering Q1 2023

Organizations are redefining their digital footprints to preserve and grow their customer and employee relationships. Digital transformation has paid dividends to these early adopters but is quickly becoming a deeper requirement to grow and compete in the broader market. The pandemic only highlighted the need for greater tech-enablement to engage newly at-home workforces and digital consumers. As a result, companies rapidly adopted digital engineering initiatives and are continuing investment in a post-COVID world to ensure long-term success and agility to the emerging technologies that are reshaping their industries.

Last April, EY released its 2022 Digital Investment Index, which surveyed 1,500 global C-level executives with digital technology decision-making responsibility from industries worldwide. Three important takeaways from this report:

1.Adopt or risk falling behind – Companies are making record-breaking investments in digital transformation, up 65% from 2020. Most view this as a top business imperative and critical for survival.

2.Executives are optimistic on their return of digital investments – Companies that measure RODI (Return on Digital Investment) expected a 7.6% average return on their digital investment in 2022. If achieved, this would nearly double the 4.4% RODI that they reported achieving in 2021.

3.Companies can accelerate innovation and increase value through inorganic investments – 55% of respondents cited choosing inorganic investment, such as M&A and partnerships, over building digital capabilities in-house. Easier access to capital and the quality of tech assets in the market have opened a new pathway for businesses outside of organic growth strategies.

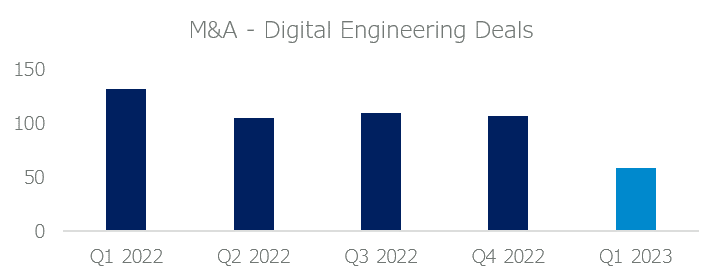

Propelled by technologies such as artificial intelligence, machine learning, data analytics, internet of things (IoT), cloud computing, and cybersecurity – digital engineering has garnered private equity and strategic interest. Market activity has remained robust through Q1 2023 with recorded breaking deals announced. In-demand partnerships and attractive geographic footprints – such as US, European, Latin American, or Indian delivery – are important considerations for investors. In the current competitive market, buyers are willing to pay premium valuations for assets that “check the box” on these considerations.

7MA has recently completed numerous M&A transactions for Digital Engineering companies and has developed unparalleled deal expertise and knowledge of the industry trends, valuations trends, and most active strategic and financial buyers. Please contact Leroy Davis, Tripp Davis, Kristina Sergueeva, or Ilia Ulianchuk if you would like to learn more about 7MA’s Digital Engineering practice.