September 2021

Market Update: Cybersecurity & Infrastructure Services – Q2 2021

In 2020, the global Cybersecurity industry rose to the top of all IT priority lists as workforces shifted to remote environments, creating new areas for exposure. This movement led to an extremely high demand for cyber software and services, not only as the result of more exposure within IT environments, but also the rising quality and sophistication of malicious attacks. As a result, analysts believe that the industry will grow by nearly 2.5x, from $167 billion in 2020 to roughly $382 billion in 2028.

Currently, infrastructure protection and identity and access management (IAM) are taking up the largest shares of revenue in security type and solution type, respectively. As for industry market demand, government/defense players are taking up the largest share with Healthcare players growing at the quickest rate.

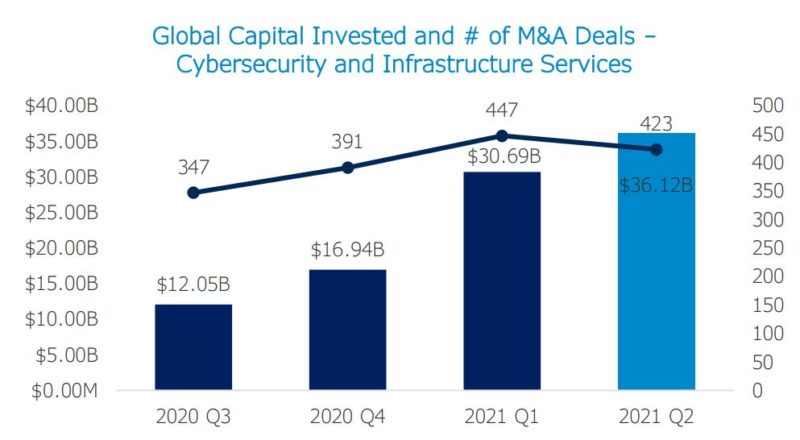

The second quarter of 2021 recorded 424 transactions, a 5% decrease compared to the Q1 2021 high. Deal volumes and valuations remain high as both strategic and financial buyers have been aggressively acquiring cyber analytics, management detection & response (MDR), identity authentication, and general infrastructure security service companies, across all countries.

7 Mile Advisors has completed numerous M&A transactions for companies operating in the aforementioned sectors and has developed unparalleled deal expertise and knowledge of the industry trends, valuation trends, and most active strategic and financial buyers. Please contact Garth Martin, Sydney Scadden, and/or Trent McCauley if you would like to learn more about our Cybersecurity & Infrastructure Services.