Overview

The Outsourced Warranty Fulfillment Market is growing at a healthy pace, as the role of warranties continues to evolve for enhanced customer value, new revenues, and product innovation. An important aspect of the customer experience and a key determinant in a customer’s buying decision is the ability for Original Equipment Manufacturers (OEMs) to proactively meet their after-sales warranty obligations. However, the complexities of a traditional warranty service delivery model make the after-sales services very lengthy, painful, and costly for OEMs.

The value chain of a traditional warranty fulfilment model typically requires OEMs to coordinate with their internal claims team, internal finance team, multi-support vendors, and partners who provide global warranty support to end-users on their behalf. OEMs struggle with the hassle of managing the multiple interfaces involved in this delivery model. Thus, when OEMs switch to fulfilling their warranty obligations using an outsourced technology-based model, they are given additional opportunities in their quest to derive value (i.e. customer retention and cost reduction).

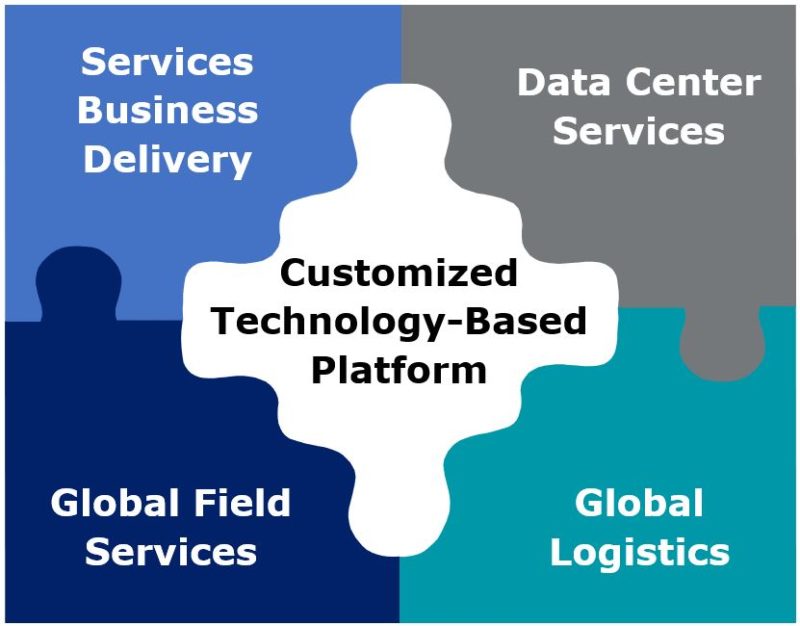

A next-generation integrated platform is transforming the warranty fulfillment process.

At the center of this transformation are outsourced technical support providers who design and develop an integrated technology-based platform that streamlines the stack of disparate elements of a traditional warranty fulfillment model. OEMs have increasingly pivoted these platforms to transform their warranty fulfilment process from a reactive low value-add activity to a more proactive, predictive results-based process. This allows OEMs to easily deploy support providers, view real time status updates, and manage the quality of services provided on their behalf by integrating their customer service systems to the platform of the outsourced technical support provider.

A snapshot of a next-generation warranty fulfillment consortium:

Overall, outsourced technical providers give OEMs a holistic view of the warranty management process by managing the communication channels between OEMs and end-users, leveraging their global network of certified field technicians, managing the day-to-day operations logistics, tracking global parts-delivery 24/7, and resolving resources issues as they occur through the closed-loop multi-vendor management hub. This warranty fulfillment model ultimately enhances customer satisfaction and allows OEMs to focus on more pressing business initiatives.

As an added benefit, the automated warranty fulfillment model also blocks the revenue leakage from lost warranty renewals. With an automated and customized platform, outsourced technical support providers can track expiring warranties and offer end-users an opportunity to renew their warranty contracts ahead of time. Again, by accessing their integrated customer service systems, OEMs gain full visibility into this warranty renewal process and get real-time status reports logged by deployed support providers.

Some key publicly traded IT Solutions companies whose capabilities include warranty solutions support:

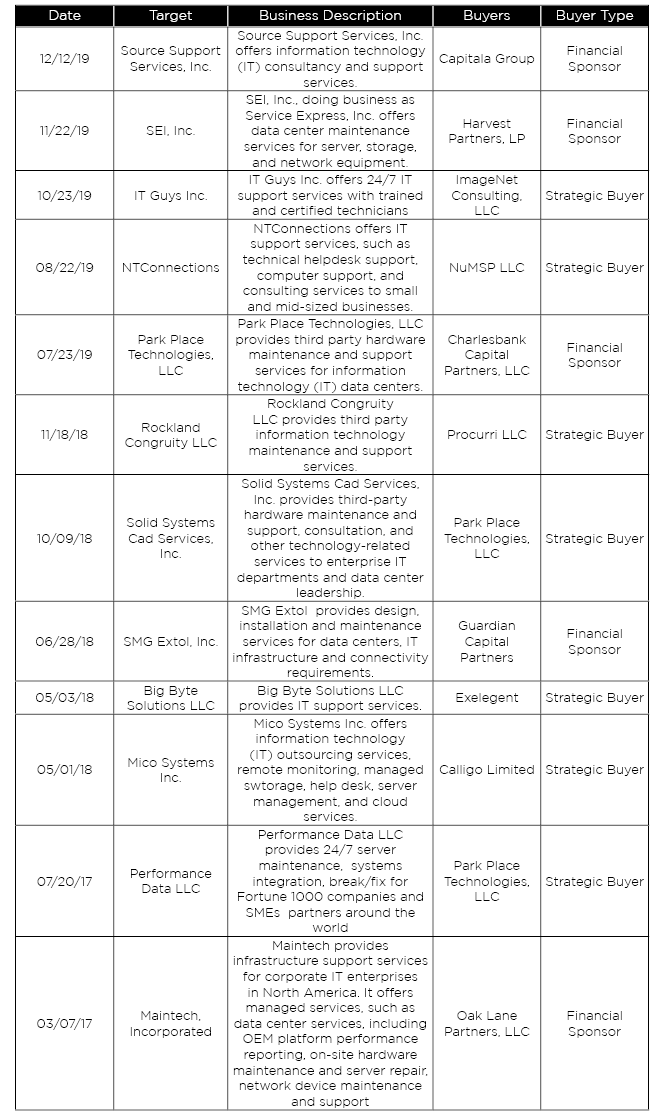

M & A Landscape

The global multi-vendor IT support services market, which was valued at $53.09 Billion in 2018, is expected to grow at a CAGR of 2.52% by 2023 [2]. A significant increase in M&A activity has been triggered by the rapid acceptance of the warranty fulfilment solutions provided by multi-vendor IT support. While Private Equity firms are harnessing scalable portfolio companies in this lucrative market, companies who dominate the space are looking to strategic collaborative initiatives to increase their market shares and profitability. Some notable transactions in this space include:

Recent 7 Mile Transaction in This Space

7 Mile Advisors provides Investment Banking & Advisory Services to the Business Services & Technology Industries globally. We help our clients sell companies, raise capital, grow through acquisitions and evaluate new markets. We advise on M&A and private capital transactions, and provide market assessments and benchmarking.

7 Mile recently acted as the exclusive sell-side advisor to Source Support in its sale to Capitala. Source Support provides outsourced product support services for technical equipment manufacturers across a variety of industries, including information, medical, and industrial automation technologies. It delivers 24×7 on-site support services, implementation services, and global service parts logistics for mission critical environments in more than 100 countries around the globe.

The acquisition, which was announced in Q4’19, strategically positions Source Support for an explosive growth as it enables the company to invest in new areas such as technological advances, expanding vertical markets, and growing sales capabilities and resources.

Sources:

- [1] ReportLinker

- [2] CISION PR Newswire

- [3] Transparency Market Research

- [4] Cognizant

- [5] Mordor Intelligence

- [6] Source Support Datasheet

- [7] Source Support Resources

About 7 Mile Advisors:

7 Mile Advisors provides Investment Banking & Advisory Services to the Business Services & Technology Industries globally. 7 Mile Advisors advises on M&A and private capital transactions, and provides market assessments and benchmarking. As a close-knit team with a long history together and a laser focus on our target markets, 7 Mile Advisors helps its clients sell companies, raise capital, grow through acquisitions, and evaluate new markets. For more information, including research on the M&A markets, visit www.7mileadvisors.com.