The Monthly Claim – July 2021

A roundup of notable news and transactions in the Insurance and InsurTech sectors

Industry Updates

The best articles from around the web for Insurance industry leaders

Capital Raise: Insurance Tech Startup bolttech Raises $180m, Valued at Over $1b via Reuters

- Insurance tech startup bolttech said it raised $180 million in a funding round, led by private investment firm Activant Capital Group, which valued it at more than $1 billion.

- The New York and Singapore-based company’s online platform serves as a matchmaker between insurance companies, allowing them to offer customers products that may not be in their area of specialization.

- “The brilliance is that the (insurance) exchange, it’s never really been done properly and everyone held on so tightly to the customers and wouldn’t sell other people’s insurance and that’s really just started to change,” said Activant Capital Partner Steve Sarracino about why he led such a big round of funding.

Market Moves: EU Signals Approval for Aon-WTW Deal but with Conditions via Property Casualty 360

- The European Commission has approved the merger of Aon and Willis Tower Watson (WTW), contingent on further divestments from both firms. The deal, however, still hinges on regulatory approval from other nations, including the U.S.

- “This is a major step that demonstrates continued progress toward obtaining regulatory clearances for the proposed combination,” the insurance companies shared in a joint statement. “Both firms operate across broad, competitive areas of the economy and believe this approval affirms that our proposed combination will accelerate innovation on behalf of clients, creating more choice in an already dynamic and competitive marketplace.”

Source: Google Images

Industry Trends: InsurTechs are Increasingly Ripe for Insurer Investments and Partnerships via McKinsey & Company

- The Insurance industry has experienced a technology revolution over the past decade. Emerging capabilities such as telematics, artificial intelligence, big data, aerial imaging, and claims automation have become more prevalent as insurers have doubled down on using technology for optimization of both cost and processes.

- However, not all insurers have been quick to adapt their in-house capabilities. Instead, they have increasingly relied on the platforms and services of a burgeoning landscape of InsurTechs, which has witnessed staggering growth in recent years.

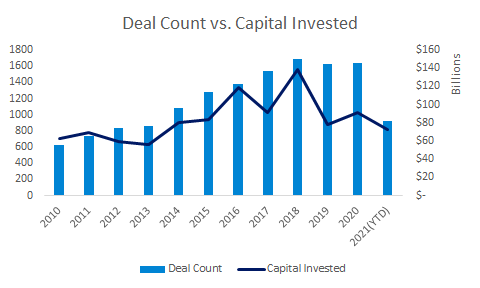

- An analysis of approximately 2,000 global InsurTechs focusing on life, property, and casualty (P&C), and health insurance found that from 2010 to 2020, about one-third of them secured funding, and a handful established strategic partnerships with at least one incumbent.

Industry Trends: Cyber Reinsurance Rates Rocket at July Renewals via Reuters

- Global cyber reinsurance rates have soared by up to 40% in the July renewal season, reinsurance broker Willis Re said, as ransomware attacks increase in number and severity.

- The average ransom payment made by a business to restore data after a cyberattack was $220,000 in the first quarter, up 43% from the last quarter of 2020, according to cybersecurity firm Coveware.

- Cyber insurance and reinsurance can cover, in addition to ransom payments, the costs of restoring the network, business interruption losses, and even the hiring of a PR agency to address reputational damage.

Industry Trends: Transforming The Insurance Industry With Big Data, Machine Learning And AI via Forbes

- Today, the global Insurance market is estimated to be a $5,050.31 billion industry, comprised of leading commercial life insurance, property and casualty, and health and medical insurance carriers.

- When insurance providers tap into the vast repositories of big data that is available to them and combine this data with machine learning and AI capabilities, they can develop new policies that can reach new audiences.

- Digital transformation of the insurance industry accelerated during the Covid-19 pandemic, as a growing number of consumers turned to digital channels to shop for insurance solutions. This prompted leading insurers to invigorate their digital transformation initiatives.

M&A Outlook

Insights and intelligence on recent notable industry transactions.

Liberty Mutual to Acquire State Auto Group via Insurance Journal

- Insurer Liberty Mutual reported that it will acquire State Auto Group, a super-regional insurance holding company headquartered in Columbus, Ohio.

- Under the terms of the agreement, State Auto mutual members will become mutual members of Liberty Mutual. Also, Liberty Mutual will acquire all the publicly held shares of common stock of State Auto Financial for $52 per share in a cash deal of about $1 billion.

- The acquisition will significantly expand Liberty Mutual’s already strong position in personal lines and small commercial insurance. It is the sixth-largest auto and home insurer in the U.S. Liberty Mutual today distributes Safeco Insurance personal auto, homeowners, and specialty products, and Liberty Mutual small business insurance through more than 10,000 independent agencies countrywide.

Source: Google Images

Arch Capital Group Ltd. Closes Acquisition of Watford Holdings Ltd via Business Wire

- Arch Capital Group Ltd. (“Arch”)[NASDAQ: ACGL], along with investment partners Kelso & Company (Kelso) and Warburg Pincus, announced the completion of the previously disclosed acquisition of Watford Holdings Ltd. (Watford).

- We are excited to complete this transaction, which will now allow our partners and Arch to move forward with the next chapter for Watford,” said Maamoun Rajeh, Chairman and CEO of Arch Worldwide Reinsurance Group. “We believe that the market conditions are ideal for us to develop the franchise and execute a strategy for Watford’s long-term success. I want to thank the teams on all sides for their dedication to successfully completing this transaction.”

- Arch Capital Group Ltd., a publicly listed Bermuda exempted company with approximately $15.8 billion in capital on March 31, 2021, provides insurance, reinsurance, and mortgage insurance on a worldwide basis through its wholly-owned subsidiaries.

AIG Plans Sale of Life Business to Blackstone and in IPO via Insurance Journal

- AIG and Blackstone said the private equity firm would pay $2.2 billion in cash for 9.9% of the unit, sending the insurer’s shares more than 6% higher in after-market trading.

- AIG had been fielding inquiries from potential investors about taking a 19.9% stake in the life and retirement unit, which sells insurance and annuities, but Chief Executive Officer Peter Zaffino in May said the company would use an IPO to sell the stake instead, dashing the hopes of bidders.

- The moves are part of AIG’s effort to split its life insurance and retirement businesses off from its property and casualty operations, which was announced in 2020, years after activist investors targeted AIG for a break-up.