The Blueprint – October 2021

Actionable Intelligence for Leaders in the Architecture, Engineering, Environmental, Geospatial, and Construction Services Industries

The ubiquitous challenges shaping the current environment for supply chain logistics and manufacturing has highlighted the need for expedient and permeating changes across the Manufacturing industry and the industries tangent to it. With a focus on improving efficiency, productivity, and the agility to respond to changes in operating environments real-time, several key trends are anticipated to emerge in the Industrial Automation and IoT space.

Research has shown that digital transformation has been the primary driver of spending for automation technology across the batch, discrete, and continuous process industries. IoT platform software and data acquisition and analytics are trending as top areas of investment as operators continue to value the agility to respond to real-time changes in manufacturing and operating environments and derive insights that will inform day-to-day decisions. Cybersecurity spending is expected to continue as recent highly pervasive and public cyber attacks have highlighted the importance of strong protection of IT infrastructures across all industries. These spending trends suggest that decision makers are currently prioritizing investment in advanced process automation and data-centric initiatives in the digital transformation journey of their organizations.

As the global economy continues to emerge from the COVID pandemic, organizations who have prioritized strategic investment in the technological capabilities of their processes and operations are realizing significant benefits. Investments in IoT are enabling manufacturers to collect, manage, and analyze data in a manner that is more time and cost-effective than ever before. Many companies have implemented smarter production floor tactics, which has improved the safety of employees and customers in the new work environment, ultimately reducing downtime and improving productivity. Organizations that have invested in e-commerce capabilities, regardless of whether or not their legacy business model leaned heavily on e-commerce, have benefited from an expanded reach and compatibility with an increasingly digital global marketplace. Data has shown that 2021 has had just over two billion digital shoppers globally so far, a trend that is anticipated to continue for the foreseeable future, and expected to see continued growth even as direct impacts from the pandemic subside.

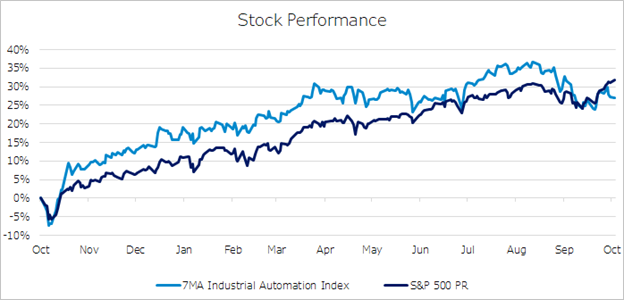

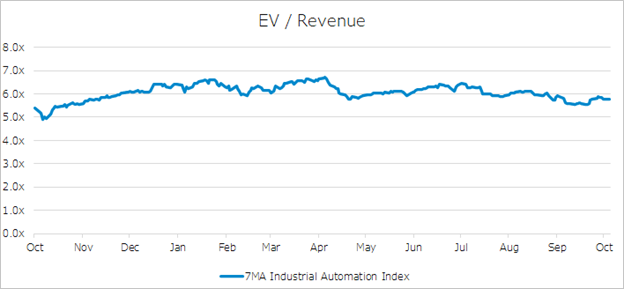

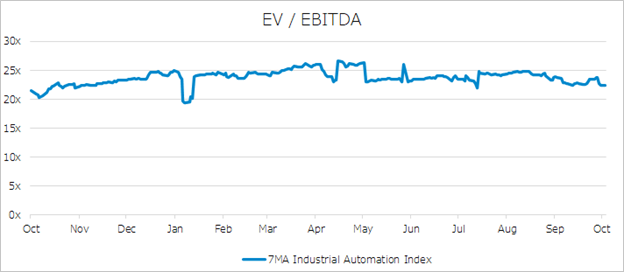

Industrial Automation stock performance measured by 7MA’s sector index has grown approximately 30% over the last twelve months, outperforming the broader market until September of this year. The overall market and the Industrial Automation index both fell in September, but investor concern around the U.S. government debt ceiling have eased, and both indexes have seen a rebound in October. The overall market has slightly outperformed the Industrial Automation index in the past 30 days, which is attributable in part to consumer concerns about the impending supply chain backlogs around the holiday season and not being able to receive needed items in a timely manner. Over the last twelve months, average sector revenue multiples have stayed in between 4.9x – 6.7x, and are currently at 5.8x, slightly below the average over the period of 6.1x. EBITDA multiples have been around 19.4x – 26.6x over the past twelve months, and are currently at 22.5x, also slightly below its average of 23.8x.

The Download

The best articles from around the web for AEC industry leaders.

- 5 Manufacturing Trends to Look Forward to in 2021 via Robotics & Automation News

- Automation Spending Trends Diverge in Continuous Processing via Automation World

Transaction Talk

Insights and intelligence on recent notable industry transactions.

Emerson Electric Co (NYSE: EMR) and AspenTech (NASDAQ: AZPN) entered into an agreement that will see EMR contribute its industrial software businesses OSI Inc. and Geological Software business to AspenTech to help create a diversified, high-performance industrial software leader with greater scale, capabilities, and technologies. The transaction will accelerate EMR’s software investment strategy as the company will continue to build a higher growth, more diversified, and sustainable portfolio by creating an industrial software company with immediate scale and relevancy in a fast-paced and evolving market. Following the transaction, the combined entity will have a global footprint with strong go-to-market capabilities and an attractive environment for highly sought-after software talent.

TPG Capital acquired Nintex, a software company with RPA capabilities, from Thoma Bravo. The Nintex cloud platform supports intelligent forms, advanced workflows, digital document generation, e-signatures, and RPA. As a result of this deal, Nintex will be able to invest more into its R&D resources in its market-leading automation solutions, expand go-to-market programs, and continue adding complementary process technologies.

Kore Wireless (NYSE: KORE) made its debut in the public markets via combining with Cerebus Telecom Acquisition Corp, a SPAC. KORE is a global leader in IoT solutions and worldwide IoT Connectivity-as-a-Service and is one of the first global, pure-play IoT businesses to become a publicly listed company. President and CEO Romil Bahl is very bullish on the next few years for the IoT industry and expects to see the market grow from about 12 billion IoT devices that were in existence at the end of 2020 to 75 billion by the end of 2030.

Affluence Corporation (OTC PINK: AFFU), a diversified technology company that focuses on innovative edge cloud, IoT, and 5G enhancing technologies, recently announced that it is bringing an industrial IoT solution to market through its pending acquisition of Saamarthya. CEO James Honan, Jr. said that this solution will be a unique one to the market as it will be a fully integrated and intelligent closed loop solution, as opposed to the disparate islands of automation that currently exist in the market. The Supervisory Control and Data Acquisition (SCADA) market is currently valued at $9.2 billion and is projected to grow at a 7.6% CAGR and reach $13.2 billion by 2026. AFFU’s Industrial IoT solution will utilize AI to analyze data and make decisions in a cloud-based environment so that SCADA monitoring can be accomplished remotely using tablets and smartphones.

About 7 Mile Advisors

7MA provides specialized Investment Banking & Advisory Services to the professional service firms in the Consumer Products & Retail industries. We help our clients determine the right strategic partners for their businesses, transition ownership, raise capital, grow through acquisitions, and evaluate new markets. We advise our clients on M&A and private capital transactions, and provide unique market insights. Our team brings experience and energy to all of our engagements, with a focus on helping our clients navigate a changing marketplace.

To learn more about how 7 Mile Advisors can help you evaluate and execute on strategic M&A or private capital alternatives for your business, please visit our website www.7mileadvisors.com.