E-commerce Edition | Nov. 2021

The E-commerce industry is still experiencing market tailwinds after the world’s strong digital transformation transition due to the pandemic. Holiday shoppers started early this year having spent over $72.4 billion in October, an 8% year-over-year growth. This data correlates to the fact that 87% of U.S. consumers plan to make at least some of their purchases online, a 13% increase over the same period in 2020. The Adobe Digital Economy Index found that toy sales, groceries, and grift cards are driving the increase in spending throughout October. Toy sales were up 50% compared to September and grocery sales were up 34%.

While E-commerce demand continues to grow, the global supply chain crisis is affecting all industries and verticals, especially those that depend on a fully functioning supply chain for their sales. Thus, alongside the increased buying were more reports of out-of-stock messages, which grew 250% in October compared to the last pre-pandemic period in January 2020. Consumers reportedly saw more than 2 billion out-of-stock messages online. Electronics, jewelry, apparel, garden, and pet products were the categories that had the highest out-of-stock levels. The Index also noted that discounts have fallen this year compared to last year. For electronics, retailers and only offering discount at 8.7%, a decrease compared to the 13.2% in October 2020.

Furthermore, Gartner assumes that by 2025, 75% of B2B manufacturers will sell directly to their customers via E-commerce. This correlates to the skyrocketing increases in revenue with B2B surpassing B2C and being the more active segment in the e-commerce transaction space.

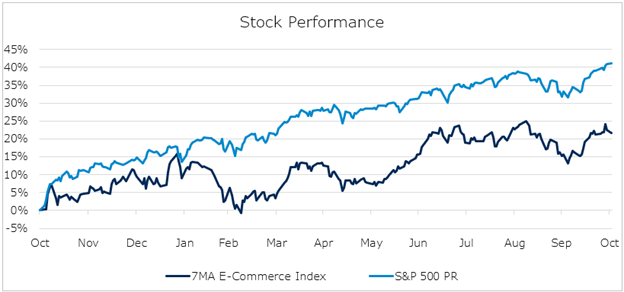

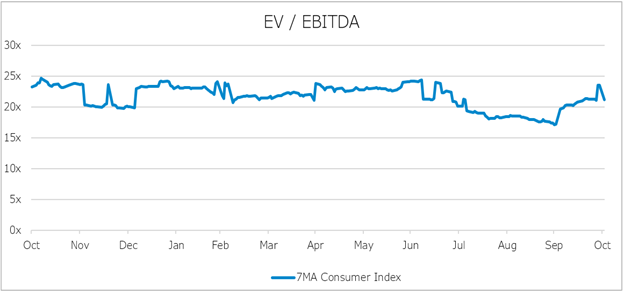

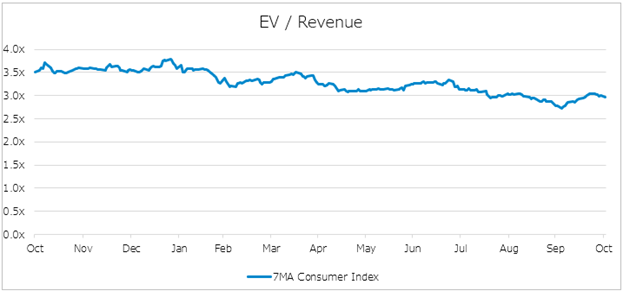

E-commerce is here to stay, but as the world begins to return to some normalcy and the extreme levels of online shopping over the past year make way for more in-person retail and experiences, e-commerce’s share of overall retail has reset lower than the peak last year. Holidays have already started to demonstrate the convenience and competitive pricing of e-commerce, resulting in a 0.5x increase in EV/Revenue and 3x increase in EV/EBITDA since September. The 7MA Consumer Index consists of digital and traditional (conventional brick-and-mortar) consumer players.

The Download

The best articles from around the web for Consumer Products & Retail industry leaders

- Why More than Half the Millennials Prefer to Shop Online in Non-metros via The Times of India

- Alibaba, JD Smash Singles Day Record with $139b of Sales and Focus on ‘Social Responsibility’ via CNBC

- Saks E-commerce Unit Begins IPO Preparations via The Wall Street Journal

- Online Grocery Shopping Activity Projected to Climb via Supermarket News

- Online Retailers Fuel Inflation in Reversal of Years-long Trend via Financial Times

Transaction Talk

Insights and intelligence on recent notable industry transactions

Accenture Acquires Openmind and Glamit, as Well as a Minority Stake in Ideoclick

Global IT consulting firm Accenture has acquired Openmind, an Italian boutique commerce agency. Openmind, founded in 2004, is based in Monza, Italy. Approximately 110 employees from Openmind will tuck into Accenture Interactive in Italy, the buyer said. Openmind’s consulting expertise spans commerce, content, strategy, experience design, and technology. The company is focused on the Italian Fashion industry but offers specific expertise with cloud-based platforms. Accenture also expects Openmind to boost its e-commerce expertise across software platforms such as Adobe, Salesforce, and SAP.

Accenture has acquired boutique e-commerce agency Glamit. The acquisition enhances Accenture Interactive’s existing omnichannel e-commerce and marketing solutions and reinforces Accenture’s SynOps platform. Glamit, founded in 2011, provides e-commerce and platform architecture, brand strategy, digital marketing services, and direct-to-consumer solutions. Key partners include Magento, VTEX, and Mercado Pago. The company is based in Buenos Aires, Argentina. Glamit’s 260 employees will tuck into Accenture Interactive’s HSA (Hispanic South America) division.

Accenture acquires a minority stake in Ideoclick, an e-commerce optimization platform provider. The platform complements Accenture Interactive’s existing digital omnichannel e-commerce and marketing solutions and services. The result: consumer brand manufacturers will gain improved customer connections, the firms assert.

Instacart Inc. is Acquiring Caper AI

Instacart Inc. is acquiring Caper AI, a startup that makes self-checkout shopping carts, for $350 million in cash and stock to tap more areas of growth ahead of the online grocery giant’s anticipated public stock offering.

About 7 Mile Advisors

7MA provides specialized Investment Banking & Advisory Services to the professional service firms in the Consumer Products & Retail industries. We help our clients determine the right strategic partners for their businesses, transition ownership, raise capital, grow through acquisitions, and evaluate new markets. We advise our clients on M&A and private capital transactions, and provide unique market insights. Our team brings experience and energy to all of our engagements, with a focus on helping our clients navigate a changing marketplace.

To learn more about how 7 Mile Advisors can help you evaluate and execute on strategic M&A or private capital alternatives for your business, please visit our website www.7mileadvisors.com.