To date, the Insurance industry has yet to be substantially disrupted by new technology. As other industries are rapidly being reshaped by technological innovations and evolving business models, the insurance industry is falling behind. However, the industry is moving into a critical inflection point as the FinTech community sets its sights on insurance as the next big opportunity. Simultaneously, the insurers and insurance service providers appear increasingly ready to adopt new technologies in the COVID-19 economy as they seek new ways to work and interact with customers.

A new class of venture-backed InsurTech startups have begun to disrupt incumbents in the industry by exploiting the weaknesses of the traditional insurance environment. These InsurTech startups have developed new approaches, such as creating claims processing software that is much more efficient as compared to the traditional labor-intensive process that has dominated over the past decades. As insurance carriers and service providers begin digitizing business processes, reducing operational costs, and satisfying consumer expectations, many insurers will turn to these InsurTech companies to improve the overall service and broker/customer experience.

What is InsurTech and how is it implemented?

InsurTech is the use of technology to transform and improve the efficiency of the current insurance industry’s business model and approach. The InsurTech ecosystem is made up of technology providers and other companies developing innovative products that reconstruct the way the world uses insurance. A majority of the technology-focused companies are using data analysis, artificial intelligence, and machine learning in order to reduce fraud and/or enhance the traditional and outdated industry business models.

InsurTech companies are beginning to implement a consumer-oriented approach by applying convenience, speed, and transparency with the use of technology in order to focus on the overall customer experience. First, convenience includes a system that creates easy to understand options that are laid out in a concise manner for a more simplified user experience. Next, speed is focusing on the ability of InsurTech companies to rapidly collect a wide array of information from its customers using machine learning and artificial intelligence capabilities in order to create claims and provide other services. Lastly, transparency targets price visibility between insurance companies and allows customers to pick the most optimal package (coverage and rate).

While the number of technology options is extensive, the Insurance industry is traditionally slow to adopt and highly regulated. As such, change is not likely to occur as rapidly as other industries. Many traditional insurance companies are just beginning to start venture funds to partner with these upcoming InsurTech companies. Overall, the combination of the insurance industry’s archaic business models/methodologies and rapidly proliferating technology solutions suggests a long runway ahead for technological innovation within the industry.

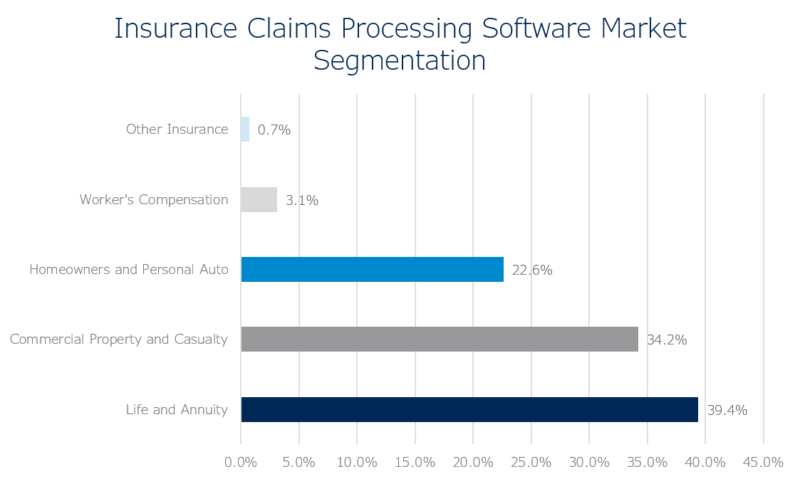

Source: 2020 Insurance Claims Processing Software Report, IBIS World

Notable Insurtech Companies

As the InsurTech industry becomes more popular, the space naturally becomes more competitive. Three companies (Bestow, Lemonade, and Root, Inc.) have stood out in the following sub sectors of life, homeowners, and auto insurance:

Bestow allows its customers to purchase life insurance products online and leverages prognostic analytics to instantly establish risk and grant its customers access to a broad array of life insurance solutions.

Lemonade is a homeowners InsurTech company that offers renters and homeowners insurance powered by artificial intelligence and behavioral economics. The company is growing into all 50 states and offers contents and liability insurance in Germany and the Netherlands. Lemonade is the first InsurTech company to go public after its IPO date on July 2, 2020. Lemonade’s stock opened at $29 and ended the day at $69.41, a 139% gain.

Root, Inc. is the first InsurTech startup outside the healthcare sector and focuses on car insurance across the majority of the United States. Root’s app accesses its customer’s phone GPS to measure driving behaviors including speed, braking, time of day driving, and ride smoothness. After a test run period, Root will send its customers a quote or decline to cover you based on the app’s machine learning and monitoring capabilities.

2020 InsurTech M&A Update

Despite COVID-19 and the associated economic shutdown, the Insurance and InsurTech markets have accelerated existing trends as companies are working to digitize the industry. This has caused a number of funding deals and M&A activity to occur throughout 2020.

In Q1 2020, the InsurTech sector had roughly $1b in financing spread across 81 deals, which was an increase from the previous quarter in 2019. Some notable deals during Q1 include PolicyGenius’ $100m raise led by KKR and AXA and Justworks’ $50m raise led by Union Square Ventures and FirstMark. Furthermore, M&A activity in Q1 of 2020 weighed heavily towards Europe but overall the sector closed 20 transactions. Moving into Q2 with COVID-19 still present, the InsurTech market continued to show growth in digitizing the industry through steady financing and M&A activity. A total of 59 financing deals and 21 M&A transactions occurred during the second quarter.

A notable InsurTech company that has announced two M&A deals in 2020, closing one in the Q1, is Bold Penguin. Bold Penguin is a commercial insurance company that uses API technology to power both consumer and agent-facing interfaces to create a fully customizable experience. Bold Penguin’s CEO and founder was an original founder of Root Insurance in the auto subsector of InsurTech. Bold Penguin is trying to position itself as a market leader in the billion dollar commercial insurance connectivity space. Overall, companies like Bold Penguin and many others are slowly beginning their rise as we see digital transformation continue to permeate the Insurance industry.

About 7 Mile Advisors

7 Mile Advisors provides Investment Banking & Advisory Services to the Business Services & Technology industries globally. 7 Mile Advisors advises on M&A and private capital transactions, and provides market assessments and benchmarking. As a close-knit team with a long history together and a laser focus on our target markets, 7 Mile Advisors helps its clients sell companies, raise capital, grow through acquisitions, and evaluate new markets. For more information, including research on the M&A markets, visit www.7mileadvisors.com.