Demand for Oracle Application and Infrastructure Services is Rising.

By Ilia Ulianchuk | March 29, 2021

Should We Expect an Increase in Oracle Cloud M&A Activity in 2021?

Overview

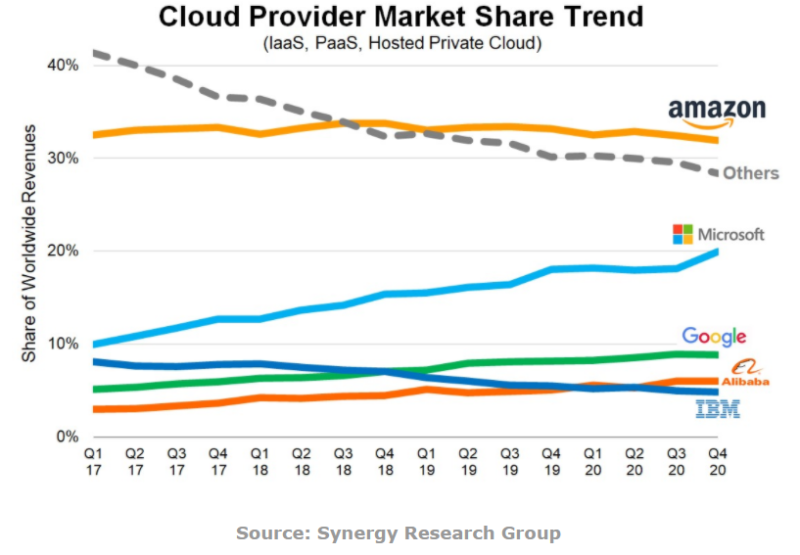

Cloud computing in 2021 has become the de facto choice of IT due to digital transformation shifts accelerated by remote work and the COVID-19 pandemic. New data from Synergy Research Group shows that Q4 2020 spend on cloud infrastructure services increased by $2.8 billion over the previous quarter, which is by far the biggest quarterly increment the market has seen. At 37% the year-over-year growth rate is slowly decelerating, but this is due to the massive scale of the market, which forces growth rates to moderate.

Figure 1. Cloud Provider Market Share Trend

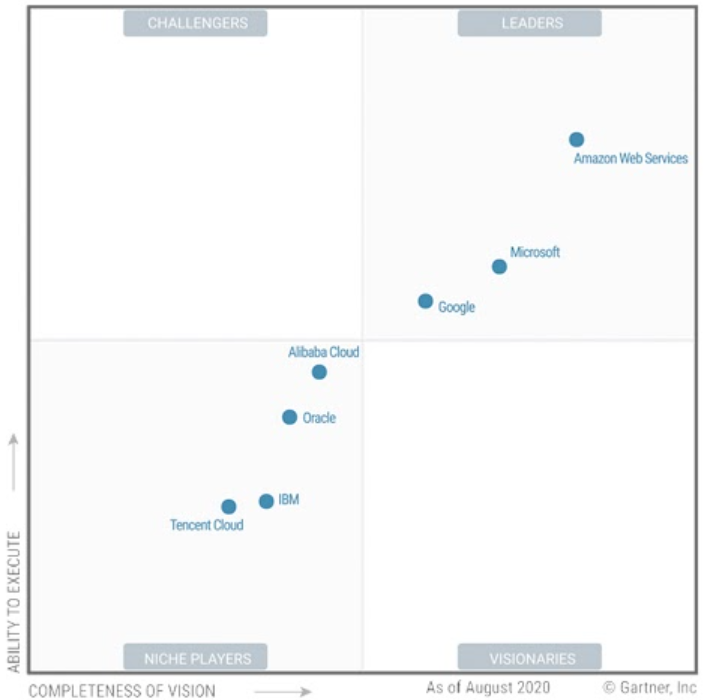

The true cloud technology leaders are Amazon (Amazon Web Services or AWS), Microsoft (Azure), Alphabet (Google Cloud), IBM, Alibaba, Tencent, and Oracle. According to data researched by Trading Platforms, the top 4 cloud infrastructure vendors accounted for 67% of the market share during Q4 2020. AWS had the largest percentage at 32%, followed by Microsoft Azure at 20%. Google Cloud had a share of 9%, while Alibaba Cloud accounted for 6%. While AWS and Microsoft Azure are clear market leaders, other players have demonstrated an accelerated revenue growth in cloud revenue in Q4 2020 including Google Cloud and Oracle. In this blog, 7MA will highlight the impressive growth and transformation of Oracle Cloud (“OCI”) business, analyze the demand for Oracle Cloud from enterprises, understand the reasons of enterprises to choose Oracle platform versus other vendors, and dive deeply into recent M&A trends involving Oracle Cloud providers.

Figure 2. Magic Quadrant for Cloud Infrastructure and Platform Services 2020

Oracle’s Cloud Revenue is Booming

Despite a rocky start with early cloud endeavors, Oracle has made impressive strides with its Oracle Cloud Infrastructure business, including some impressive layers of automation in its Generation 2 Cloud that make it more scalable and robust. The company has invested heavily in infrastructure to expand to more than 25 regions, with plans to reach 36 by mid-2021.

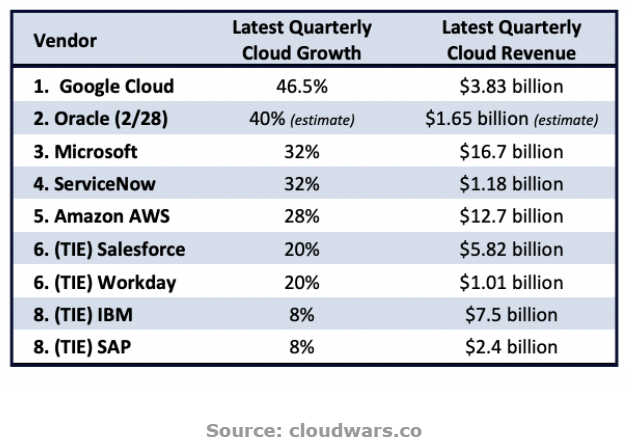

The world’s 6 fastest-growing major cloud vendors posted recent quarterly growth rates spanning 25% average growth rate and generated a total of about $44 billion in cloud revenue. While Google Cloud demonstrated a tremendous revenue growth last quarter, Oracle came in 2nd, boosting its cloud at revenue 29% (estimated) in Q3 2021 and expanding its cloud business far more rapidly than other cloud providers listed below.

Figure 3. Last Quarter Cloud Revenue Growth

Oracle had demonstrated exceptional results in Q3 2021 when it came to growth in its cloud, recurring revenue, and subscription businesses, the company announced in March 2021 during its earnings call. Management tried to focus on cloud computing services to revive languid revenue growth as the world’s second-largest software maker. Customer interest in the firm’s internet-based applications has finally offset declining demand for its legacy tools. Oracle reported strong growth in several of its key cloud product categories:

- Fusion ERP product saw its revenue increase by 30% YoY

- NetSuite Cloud ERP revenue grew 24% YoY

In summary, Oracle’s rapidly growing highly-profitable, multi-billion dollar cloud ERP businesses helped drive subscription revenue up 5% and operating income up 10% in the quarter. Subscription revenue now accounts for 72% of Oracle’s total revenues, and this highly-predictable recurring-revenue stream along with expense discipline are enabling double-digit increases in non-GAAP earnings per share. Oracle anticipates this trend to continue as cloud services continue to grow.

Enterprises Choose Oracle

In September 2020, Oracle announced that the Company is trying to become a technology partner and cloud computing services provider to ByteDance Ltd.’s TikTok in its bid to land major customers for its public cloud, but the deal remains mired in U.S. regulatory review. Oracle stated it would take a 12.5% stake in TikTok and would run its cloud security and services. If this partnership happens, Oracle will move TikTok to its cloud from the app’s current providers, which include Alibaba and Google, according to a CNBC report.

Last year, Oracle also picked up a slice of business from Zoom, which was looking to diversify its spending off AWS as usage surged during the coronavirus pandemic. According to a CNBC report and Oracle’s press release, Zoom selected its cloud for its advantages in performance, scalability, reliability, and superior cloud security. The CNBC report also stated that Zoom picked Oracle because they are proven in the enterprise in terms of mission-critical apps built on Oracle databases running on Oracle hardware in the cloud. For Cloud, Zoom has long been reliant on AWS, while also handling a lot of capacity from its own data centers. The company admits its infrastructure wasn’t prepared for a global pandemic that would send millions of office workers and students home almost overnight, with Zoom as the primary way they would be staying in touch with co-workers, friends, and family members. The number of daily meeting participants jumped from a high of 10 million in December to more than 300 million this month. Also, Zoom CNBC reported that Zoom would rather not fund its video rivals’ cloud businesses, which have been growing rapidly as large enterprises move away from traditional data centers.

Indian independent software vendors are also quickly moving to Oracle Cloud, according to Telecom.com. Shailender Kumar, Regional Managing Director at Oracle India, said in a statement that a large number of Indian independent software vendors (ISVs) including GOFRUGAL, Medexpert, Ameyo, and Information Dynamics, among others are choosing to run their business-critical applications on Oracle Cloud Infrastructure (OCI) to improve application performance and accelerate business growth. Other midsize independent software vendors that have moved to Oracle Cloud (OCI) include Jocata, IBSFINtech, Invensoft, TecWink, QuarkCube.IO, amongst others. The top reason for that:

- Significant performance improvement on OCI

- Oracle Cloud’s pricing structure

- OCI received the highest satisfaction score, as well as the biggest year-over-year score increase amongst all Infrastructure as a Service (IaaS) providers in IDC’s latest CloudPath survey 1 of 935 IaaS customers

Moreover, Oracle announced the expansion of its partnership with Altair, a global technology company providing solutions in data analytics, product development, and high-performance computing (HPC). As part of the multi-year agreement, Altair will enable many of its internal workloads and commercial Software as a Service (SaaS) to run on Oracle Cloud Infrastructure, including its portfolio of high-performance engineering simulation and analytics products.

Gartner’s 2020 “Critical Capabilities for Cloud Database Management Systems for Operational Use Cases” report recognized Oracle Autonomous Database and Cloud Database Management Systems (DBMS): Oracle Autonomous Transaction Processing (ATP) ranked highest in the following four use cases: traditional transactions, augmented transaction processing, operational intelligence, and stream/event processing. Additionally, Oracle Autonomous Data Warehouse (ADW) ranked first in Operational Intelligence.

In summary, Oracle is increasingly targeting top global enterprises (TikTok and Zoom) for its Cloud business and extending contracts/partnerships with its top customers, all of which are displayed in its impressive revenue growth.

Recent Oracle Cloud M&A Deals

The top M&A players in the Oracle Cloud space are some of Oracle’s Cloud Elite and Global Cloud Elite Partners.

Top Oracle Cloud Strategic Acquirers

The top Oracle Cloud strategic acquirers include Deloitte, Accenture, KPMG, Hitachi, Ltd., Inspirage, Aspire Systems, and Cognizant.

Deloitte

In February 2021, Deloitte acquired Oracle consultancy Focus IT in the Philippines to further enhance Deloitte’s Oracle Cloud solutions and drive value for clients across the region. In October 2020, Deloitte also acquired Ekulus, an Oracle Cloud service and data management solutions provider based in Australia. Deloitte previously acquired NeoData Australia, which specialized in support of Oracle business intelligence systems.

Accenture

In 2018, Accenture acquired Oracle Cloud partner PrimeQ, a SaaS integrator and managed services provider (MSP) in Australia for $31 million. During the same year, Accenture acquired DAZ Systems, Inc. to strengthen its Oracle Cloud ERP services, and Certus Solutions, one of the UK’s top Oracle Cloud implementation service providers.

Cognizant

In January 2021, Cognizant acquired Sydney, Australia-based Servian, an enterprise transformation consultancy that specializes in data analytics, artificial intelligence, digital services, experience design, and Cloud. Servian partners with Amazon Web Services (AWS), Microsoft, Oracle, and other providers.

Aspire Systems

In 2019, Asprise Systems acquired iApps, an Oracle ERP implementation solutions provider, and Valforma, a provider of Oracle advisory and cloud-based database management services.

Top Oracle Cloud Private Equity Investors

The top Oracle Cloud private equity investors include Trinity Hunt Partners, YFM Equity Partners, Century Park Capital Partners, RLH Equity Partners, and Madison Dearborn Partners.

In October 2020, Trinity Hunt Partners acquired InterRel Consulting, Oracle’s business analytics implementation consulting services provider. In August 2020, DSP, backed by private equity firm YFM Equity Partners, acquired Oracle consulting firm Explorer UK for an undisclosed sum. In May 2020, Washington’s Inspirage, a portfolio company of RLH Equity Partners, acquired Vertical Edge Consulting Group, a Business Intelligence (BI) firm and fellow Oracle partner. In April 2020, Century Park Capital Partners, a Los Angeles-based private equity firm, acquired Accelalpha and invested in Prolog Partners, merging the two Oracle partners into one IT consulting firm.

About 7 Mile Advisors

7 Mile Advisors provides Investment Banking & Advisory Services to the Business Services & Technology industries globally. 7 Mile Advisors advises on M&A and private capital transactions, and provides market assessments and benchmarking. As a close-knit team with a long history together and a laser focus on our target markets, 7 Mile Advisors helps its clients sell companies, raise capital, grow through acquisitions, and evaluate new markets. For more information, including research on the M&A markets, visit www.7mileadvisors.com.

Subscribe to receive newsletters and industry research, as well as details about recent transactions, new podcast episodes, and upcoming events:

Sources:

- Oracle Projects Growing Revenue After Years of Cloud Slog

- Oracle CEO Safra Catz: 10 Predictions for Fast-Growing Cloud Business

- Four Leading Cloud Infrastructure Firms Account for 67% Share of All $129bn Market

- Deloitte buys Oracle consultancy Focus IT in the Philippines

- Indian independent software vendors fast moving to Oracle Cloud

- Altair Accelerates Use of Oracle Cloud Infrastructure

- Why Zoom Chose Oracle Cloud Over AWS and Maybe You Should Too

- Zoom’s choice of Oracle cloud looks smart after Microsoft and Google’s aggressive moves in video

- Incremental Growth in Cloud Spending Hits a New High while Amazon and Microsoft Maintain a Clear Lead

- Amazon AWS | Microsoft AZURE | Oracle Cloud (Confused ?): Right Choice for DBA’s

- Deloitte’s Oracle Cloud Leader: Oracle On Oracle An ‘Easy Entry Point’ To Selling Oracle Cloud Infrastructure

- Oracle Partner Acquisition: Inspirage Buys Vertical Edge Consulting Group

- Gartner Reports: 2020 Critical Capabilities for Cloud Database Management Systems for Operational and Analytical Use Cases

- Oracle’s #1 Problem: Cloud Demand Overwhelmed Supply, Says Larry Ellison

- Oracle beats Q3 estimates with solid cloud ERP growth

- Fastest-Growing Major Cloud Vendors: Google #1, Oracle #2, Microsoft and ServiceNow #3