The COVID-19 pandemic began largely impacting the American public, and subsequently their businesses, this past March. In the beginning, many business owners, private equity groups, and M&A advisors found themselves in a triage situation – securing existing businesses and clients in an effort to prepare for the economic impact. During these early days, it was generally recognized that deal volume decreased as strategic buyers focused inward, private equity groups stopped deploying capital until they were comfortable with their current portfolio’s exposure, and M&A Advisors embraced their client’s revised forecasts. As many news outlets expressed [1] – deal flow all but stopped.

Flashforward four months and many business owners are now asking the question – is deal volume picking back up, and are deals actually getting done? While we cannot speak for everyone, from our vantage point at 7 Mile Advisors we would say the answer is a resounding “yes”. Since March 1st our firm has closed three transactions (one of which has not been publicly announced yet). We also have several projects in due diligence, 19 actively in the market, and 6 in preparation mode. We are a 20-person firm that averages 12 closed deals per year. While we can’t see the future, we do anticipate that well-performing businesses in advantageous markets will find a favorable response from active buyers in the market.

While many buyers tapped the brakes in the early days of the pandemic, we’re beginning to experience a strong upward trend in responsiveness and engagement from both strategics and investors. In both cases, we’re seeing underleveraged businesses with cash on the balance sheet in an opportunistic position to make acquisitions. We have also noticed that a bullish stock market is driving higher valuations for public companies, and historically low interest rates are giving leveraged buyers capacity to bid up. We see the debt and equity markets as giving significant “headroom” for buyers to pay up for good deals.

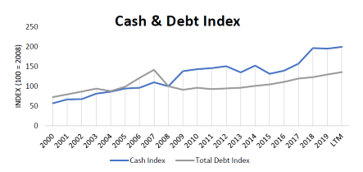

The below chart profiles an index of Cash and Total Debt levels for firms in the S&P 500 going into 2020. It’s clear that since the 2008 recession there has been a trend towards conservatism in terms of how firms view their capital structure. This certainly played a role in the comfort level many businesses entered the pandemic with, because many groups were sitting on record levels of cash and had the opportunity to “lean in” to acquisition opportunities, even during a time of economic uncertainty.

Source: CapitalIQ

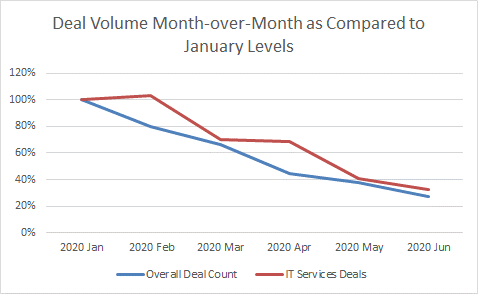

It’s also important to note that our 7 Mile vantage point is unique as compared to many other investment banks due to our industry specialization. The graph below demonstrates that as deal volume has fallen off over the past months, the IT Services industry has not seen as dramatic of an impact. As companies move to a remote-work environment, their IT infrastructure and digital presence is more important than ever – driving sales for businesses that serve into these areas. Where there is a need for services there is interest from buyers, especially in fragmented markets such as the Microsoft Azure and Managed Service Provider (MSP) ecosystems. As consolidation occurs, it creates a ripe environment for those business owners who are looking for a liquidity event.

Source: Pitchbook

The consolidation trends in the IT Services industry are driving quality deals with strong valuations and bids. Largely the acquisitions we see taking place are with well-performing businesses, not opportunistic sellers who are being forced into a sale situation. We remain optimistic that these trends will continue as we move into Q3 and Q4 of 2020. For more information about recent acquisitions and market performance view our industry specific research reports on the 7 Mile website.

Recent 7 Mile Advisor Transactions

View additional transaction details here.

About 7 Mile Advisors

7 Mile Advisors provides Investment Banking & Advisory Services to the Business Services & Technology industries globally. 7 Mile Advisors advises on M&A and private capital transactions, and provides market assessments and benchmarking. As a close-knit team with a long history together and a laser focus on our target markets, 7 Mile Advisors helps its clients sell companies, raise capital, grow through acquisitions, and evaluate new markets. For more information, including research on the M&A markets, visit www.7mileadvisors.com.

Sources: [1] The Impact Of The Coronavirus Crisis On Mergers And Acquisitions by Forbes