February 2021

M&A Report: IT Services & Software in Eastern Europe

Forward

COVID-19 dramatically changed the global economic landscape in 2020 for many regions, including Eastern Europe. The pandemic had a mixed impact on most of the IT Services and Software companies in this part of the world. The overall industry growth (3% in 2020) and M&A deal volume was down in 2020 (188 transactions) in Eastern Europe compared with those in 2019 (250 transactions), -1% and -15% respectively (1). However, we expect to see an increase in the deal activity in this region in 2021 fueled by the continuing digital transformation and demand for offshore IT outsourcing. To better understand the effects of COVID-19 on IT Services and Software companies in Eastern Europe, we took a deeper dive into top IT outsourcing countries, valuations of publicly traded companies, and mergers and acquisitions (M&A) trends to discover how COVID-19 affected the industry growth, deal volume, and M&A appetite of strategic buyers and financial institutions.

Within this ecosystem we focus on:

- Industry Snapshot

- Publicly Traded Companies

- M&A Activity (Buyer Trends and M&A Transactions)

Industry Snapshot

COVID-19 posed many challenges to the global economy in 2020. Large and small enterprises were forced to keep up with digital adoption while reducing costs on operations and innovations. The unprecedented global economic recession caused by the spread of COVID-19 has stimulated businesses to seek new IT talents outside their countries. Companies continue to outsource IT and software development functions to optimize costs and grow through the recession. Large global businesses embrace outsourcing because it helps them work with highly educated specialists for a perfect quality-cost ratio. Many of these companies outsource IT functions to Eastern Europe due to many advantages this region offers to global enterprises: massive and educated talent pool, lower salaries, convenient geographical location and time zones, language proficiency, culture similarities, and ability to upscale operations quickly, among others.

The global software development services market is expected to reach $843b by 2021 where approximately 70% of demand for Software Development services and outsourcing come from the U.S. and Western Europe (2).

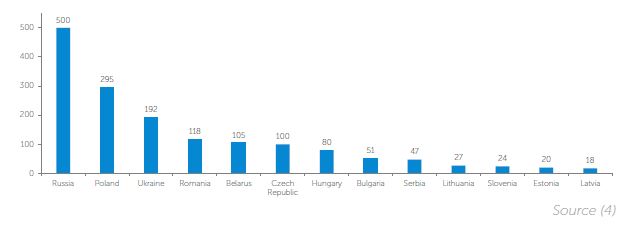

Top IT Services & Outsourcing Countries in Eastern Europe

Number of IT Specialists by Country in Eastern Europe – 2019 (In Thousands)

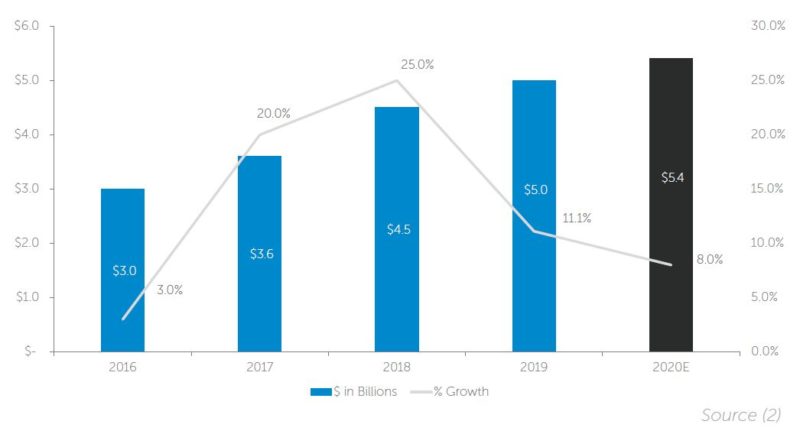

Trends by Top IT Outsourcing Countries: Ukraine

In the last 10 years, the Ukrainian IT market has grown significantly. Despite an increasing number of start-ups in the country, the leading segment of the Ukrainian IT sector has always been IT services outsourcing. According to PwC and N-iX data, the Ukrainian IT market reached $5b in 2019 and is projected to grow to 8% in 2020. As of 2019, Ukraine was home to 192,100 IT professionals, and the number is constantly growing. Over 60% of IT companies in Ukraine provide services to clients based in the US and Western Europe according to N-iX data. Despite the slowdown in the ongoing software business process due to COVID-19, which has already resulted in revenue loss, most of the Ukrainian IT companies are accustomed to working with distributed teams, have the necessary infrastructures and processes for uninterrupted work, and are prepared for all forms of disruptions according to N-iX and Daxx. Even in the situation of a worldwide pandemic, lower sales projections, and nationwide quarantine, Ukrainian IT companies are maintaining their business performance targets and meeting obligations to all customers.

IT Market Size and Growth in Ukraine ($ in Billions)

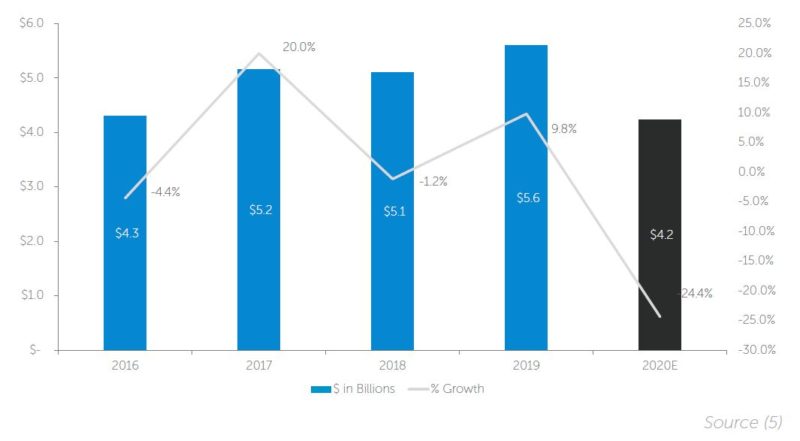

Trends by Top IT Outsourcing Countries: Russia

According to ADC, the Russian market of IT services in 2019 reached $5.6b in total volume, a 9.8% increase versus 2018. The continuing processes of the digital transformation of enterprises including cloud computing, the analysis of Big Data, Internet of Things (IoT), and artificial intelligence are the top drivers of the industry growth in Russia. According to ADC, COVID-19 has rapidly changed the economic and business environment in the country in 2020 and negatively impacted the IT services market last year. However, many executives reported that the influence of the pandemic on the IT services market in Russia was multi-directional, according to TAdviser. Many companies were forced to reduce both IT expenses and investments in IT infrastructure, others on the contrary, quickly reacted to the situation and transferred processes to “digital” and doubled on IT spending as many people began working from home. The crisis pushed many companies to accelerate digital transformation and adapt to the changing business landscape that will fuel the growth of the industry in 2021.

IT Market Size and Growth in Russia ($ in Billions)

Trends by Top IT Outsourcing Countries: Poland

Poland is one of the most alluring destinations for offshore software development in Eastern Europe. The country boasts a vast talent pool of experienced professionals, developed infrastructure, and favorable business conditions. The country has an impressive tech talent pool of 295,000+ IT specialists (2019) according to the ABSL report. Poland boasts the biggest GDP in Eastern Europe, which amounts to $596b, with the share of IT export $4.6b in 2019 according to N-iX. As 2020 changed many businesses during the pandemic, many of them will be using IT solutions that have never been used before, on such a broad scale. One of them is the remote contracting of IT specialists from emerging markets where Poland is being one of the leading IT services providers. Poland is an attractive region to global enterprises as many IT industry employees in Poland can communicate in English, German, French, and Spanish. Many Western European companies prefer nearshoring, i.e. cooperation with partners operating abroad, though relatively close. For Western Europe, the perfect place to acquire them is Eastern Europe where Poland has a dominant position.

1,400+ ITC Graduates Annually in Poland

Trends by Top IT Outsourcing Countries: Belarus

2019, Belarus has 54,200 IT specialists and around 1500 IT companies according to N-iX. Belarusian IT companies have clients in more than 50 countries all over the world, approximately 45% of them from the U.S.A. and Canada, and 30% from Europe. The exports of Belarusian IT services have been steadily growing over recent years at an annual pace of 10%. The total production and sales revenue of its IT sector amounted to $3.1B in 20183. The Belarusian IT sector has demonstrated rapid growth due to ongoing governmental support as one of the top-priority economic sectors for future development and expanding the talent pool of educated IT professionals.

The country has been affected by COVID-19 and on-going political protests. Some Belarusian IT professionals are leaving the country and seeking job opportunities in Ukraine and Poland according to the Atlantic Council’s Ukraine Alert Service. This trend will have significant negative consequences for the Belarusian economy, but the impact could go far beyond a drop in GDP according to the source. Nonetheless, the Belarusian government continuing stimulus of the IT industry will increase the number of IT professionals, as well as help the industry to prosper in the next 24 months.

PAM Systems, a leading global provider of digital platform engineering and software development services, hires most of its computer software developers in Eastern Europe, with most of its offshore centers in Belarus. In response to ongoing political movements in Belarus, EPAM has recently opened new offices in both Latvia and Georgia. During this year, the company demonstrated strong expense management which resulted in increased profits. The IT services firm is on a hiring sprint into 2021 as it continues to expand into higher-margin consulting services through acquisitions. Please see our Eastern Europe IT Services – Q3 2020 report here.

Publicly Traded Companies

Publicly Traded IT Services & Software Companies in Eastern Europe

Poland

- Sescom S.A. – Provides facility management services for retail chains in Europe. The Company offers store solutions: designing, modernizing, energy measurement, digital transformation implementation, and data analysis. Founded in 2008. Based in Gdansk, Poland.

- Comarch S.A. – Designs, implements, and integrates IT solutions worldwide. Provides IoT Ecosystem services, BSS, professional services, design services, and resource planning. Founded in 1993. Based in Krakow, Poland.

- Asseco South Eastern Europe S.A. – Sells third party software in Poland. The Company offers banking software solutions and services, an omni channel solutions and integrated systems based on Oracle and Microsoft platforms. Founded in 2007. Based in Warsaw, Poland.

- Comp. S.A. – Provides IT security and network security services and solutions in Poland. The Company offers special security systems, public key infrastructure, digital signature systems, and authentication systems. Founded in 2001. Based in Warsaw, Poland.

Bulgaria

- Allterco AD – Provides various mobile services and products globally. The Company offers SMS, voice, information, PC, application mobile, game, TV, radio, and credit card payment services. Founded in 2008. Based in Sofia, Bulgaria.

- Endava PLC -Provides digital transformation consulting, agile software development services, and various automation solutions. Founded in 2000. Based in London, UK with a large presence in Bulgaria and Romania.

- Sirma Group Holding AD – Provides software solutions and services worldwide. The Company offers technology, software development, system integration, staffing, and outsourcing services. Founded in 1992. Based in Sofia, Bulgaria.

Ukraine

- EPAM Systems, Inc.- Provides software product development and digital platform engineering services globally. The Company offers cross-platform migration, software, and management services. Founded in 1993. Based in Newtown, Pennsylvania with a large presence in Ukraine.

- Grid Dynamics – Provides technology consulting, agile co- creation, and scalable engineering and data science services. The Company also offers artificial intelligence (AI) solutions to its customers worldwide. Founded in 2006. Based in San Ramon, CA with a large presence in Ukraine.

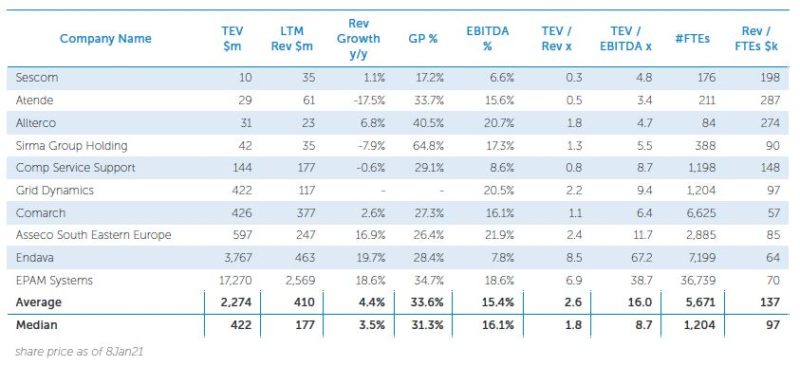

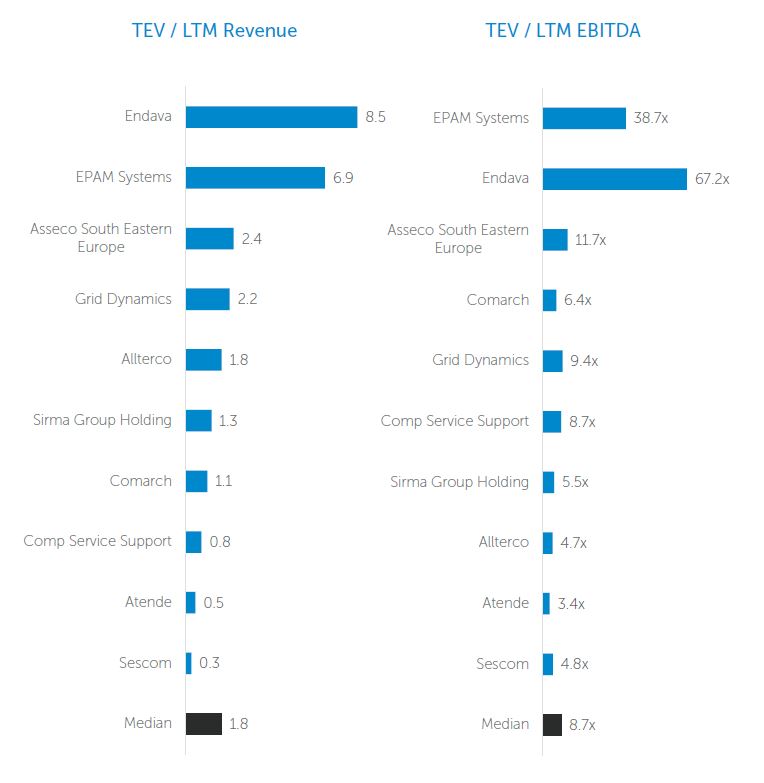

Trading Metrics and Multiples

To benchmark financial performance and multiples across the IT Services and Software sector in Eastern Europe, 7MA has developed a public basket comparison showing LTM financial performance of publicly traded companies.

Source: PitchBook Data, Inc. $USD as reported by PitchBook Data Inc as of January 8, 2021. PitchBook Data Inc used average currency conversion rates for the range of Last Twelve Months (“LTM”) for Sescom, Atende, Sirma Group Holding, Comp Service Support, Comarch, Asseco South Eastern Europe, and Endava.

Operating Metrics

Operation Metrics

Valuation

Valuation

M&A Activity

Buyer Trends

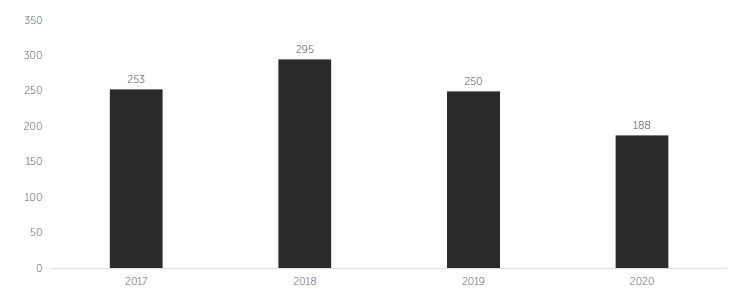

COVID-19 negatively affected M&A activity in the IT Services and Software sector in Eastern Europe. The overall deal volume in 2020 was down -15% (188 deals) compared with that of 2019 (250 deals)(1). Strategic buyers slowed their M&A activities and focused on implementing internal strategies and operations to accommodate their employees for “work-from-home” mode, ensure safety measures, and focus on internal operations. On the other hand, many financial buyers paused their investment activities to focus on their portfolio companies despite the need to deploy committed capital on behalf of their limited partners. As the new year began with many seeing the resilience of IT Services and Software sector to the pandemic, strategic players and financial institutions are revisiting their M&A strategies and investing in Eastern European, high- growth companies that benefited from the pandemic, which undoubtedly increased the speed of Digital Transformation and adoption of Cloud.

Most Active Buyers

7MA analyzed closed M&A transactions in the IT Services and Software in Eastern Europe in the last 24 months and identified the most active strategic and financial acquirers. To receive the full list of transactions, please contact 7 Mile Advisors for more information.

Reasons for Acquisitions

- Vertical capabilities: Acquisition of new verticals or deepening of existing capabilities

- Delivery diversification: Addition of new delivery geographies allows for market diversification and limits political risk, as well as adds a new talent pool

- Client acquisition: Acquisition of new clients or enhancement of current client profile

- Scale: Enables companies to bid for larger projects

- Technical / language capabilities: Enhancement of tech teams via M&A rather than through organic growth

# of M&A Transactions by Year – IT Services & Software in Eastern Europe

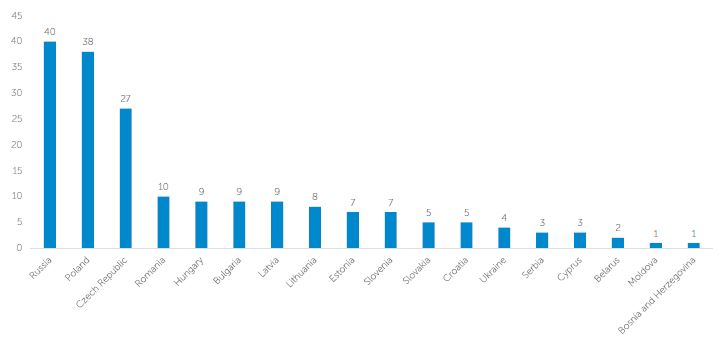

# of M&A Transactions in 2020 by Country – IT Services & Software in Eastern Europe

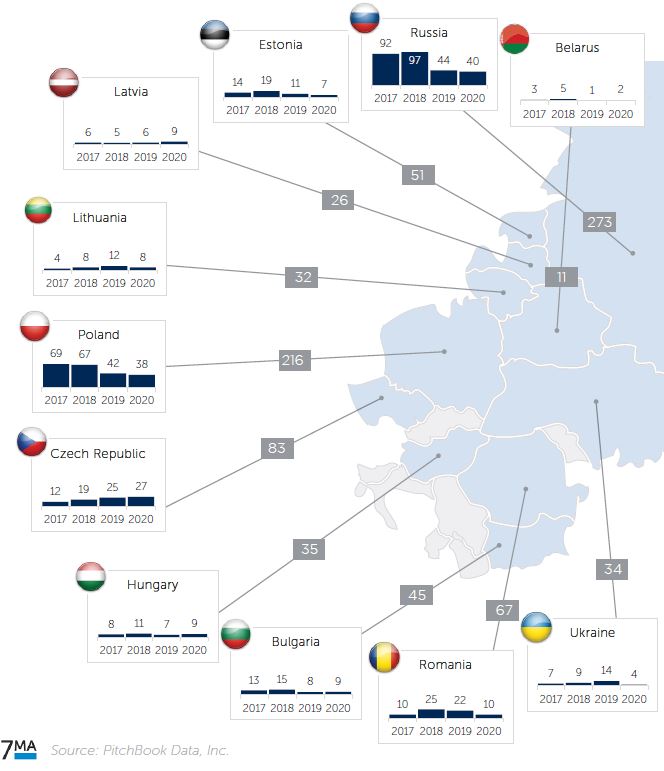

M&A Activity Map by Country (Q1 20217 – Q4 2020)

7 Mile Advisors M&A Activity

7MA has completed numerous M&A transactions for companies with outsourced operations and / or delivery centers in Eastern Europe and has developed unparalleled deal expertise and knowledge of the industry trends, valuation trends, and most active strategic and financial buyers. Please contact Kristina Sergueeva, Director at 7MA, or Ilia Ulianchuk, Senior Analyst at 7MA, if you would like to learn about recent Capital Markets trends in Eastern Europe.

7 Mile Advisors Quarterly Earnings Coverage

7MA closely follows and monitors quarterly earnings releases of leading publicly traded IT Services companies in Eastern Europe. While earnings results for Q3 2020 were mixed, management teams appeared to be excited about opportunities in their M&A pipelines, as companies continue to move past COVID-19 induced headwinds and experience an uptick in demand. Looking into 2021, Eastern European companies communicated more confidence in their forward outlook demonstrated by re-stated guidance and comments on reaching pre-COVID-19 revenue run rates. Please see our latest Eastern Europe quarterly earnings report here.

Conferences & Webinars

- IDC – Government Forum: Public Administration of the Future Publicly Traded Companies

- IDC – Resetting for the Next Normal: Strategies for Enabling the Future Digital Enterprise

Conclusion

This report covers the high-level characteristics of the IT Services and Software M&A landscape in Eastern Europe. The report offers key market metrics, M&A activity, industry snapshot, and most active strategic and financial buyers. COVID-19 paused challenges to global economies and many companies in the IT Services and Software industries which affected the overall M&A activity in 2020. 7MA believes that a combination of the central geographic location between Western Europe and South East Europe and Asia, educated work force with relatively low wage costs and language skills, and fast rate of economic development will make Eastern Europe a highly attractive destination for strategic and financial investors looking to exploit the market opportunities for growth in this region in 2021. At 7MA, we look forward to further discussing these trends and providing strategic advisory for your business.

Sources

- PitchBook Data, Inc.

- Central and Eastern Europe (CEE) Software Development Report

- Software devlopment in Eastern Europe: Belarus vs. Ukraine

- Why Outsource Software Development to Eastern Europe in 2021?

- Tadvisor – IT market in Russia

- Offshore software development in Poland: All you need to know

- Job Market Overview in Ukraine: Tendencies and Features

- How IT Companies in Ukraine Are Handling the Coronavirus Crisis

- Export of IT services from Ukraine grew by 15% to $2.43 billion

- Impact of COVID-19 on Central & Eastern European Data Center Markets, 2020-2025

- Pandemic speeds up change in the IT market

- BCG IT Spend Pulse: How COVID-19 Is Shifting Tech Priorities

- Ukrainian IT Industry 2019-2020: $5 billion and 200,000 specialists

- IT services (market of Russia)

- Digital Resiliency Strategies for the Future Enterprise

- Software development outsourcing to Ukraine: An ultimate industry overview

- Belarus’ IT industry in meltdown

- Why is it worth choosing IT outsourcing in Poland?

About 7 Mile Advisors

7MA provides Investment Banking & Advisory Services to the Business Services and Technology Industries globally. We advise on M&A and private capital transactions and provide market assessments and benchmarking. As a close-knit team with a long history together and a laser focus on our target markets, we help our clients sell their companies, raise capital, grow through acquisitions, and evaluate new markets. All securities transactions are executed by 7M Securities, LLC, member FINRA / SIPC. For more information, including research on the M&A markets, visit www.7mileadvisors.com.

Author

Ilia Ulianchuk, Senior Analyst